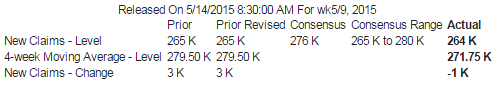

Just a reminder, claims measure those losing jobs who file for benefits, not new hires:

The euro has been moving higher vs the dollar, as CB selling winds down as they reach the lower limits of their reserve targets along with fundamental support from a large and growing EU current account surplus that’s drained those euro sold by those CB’s and other sellers from global markets. This may have left the short sellers and others needing to recover euro allocations subject to a dramatic short squeeze for as long as the current account surplus continues. And this poses an extreme risk to the EU. Growth forecasts have been largely based on ‘weak euro’ and as it moves higher that growth never materializes, and instead the economy deteriorates/unemployment goes higher, etc. etc. and, making matters worse, the ECB is left ideologically bankrupt, having seen negative rates and QE do nothing more than exacerbate the deflation they were trying to reverse. All they can do is try more of the same, which will be a very depressing environment for those who have been suffering under the failed policies. All of which has the potential to accelerate the already growing support for the various anti euro forces.

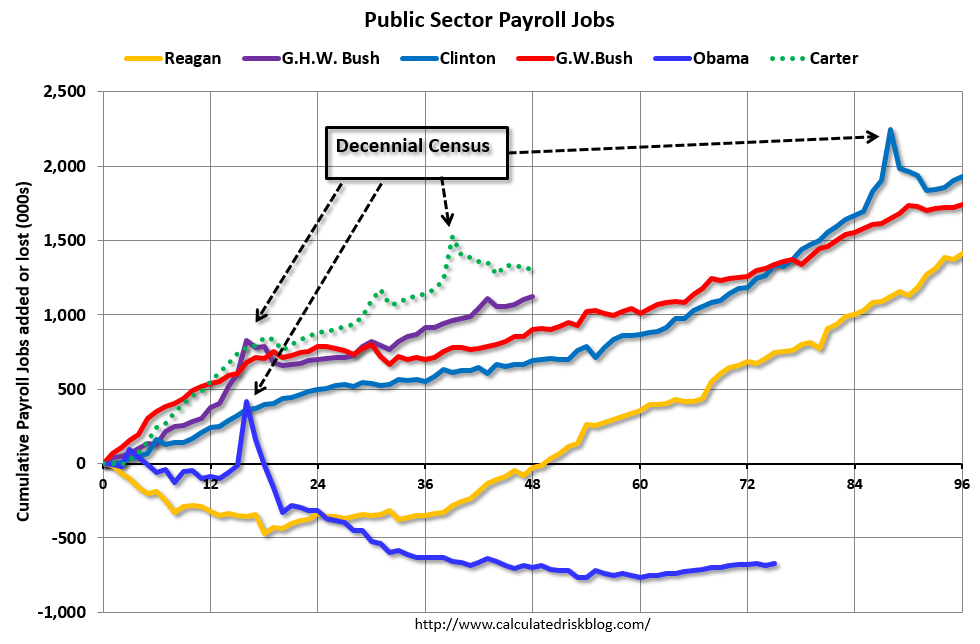

Yes, President Obama wins the Tea Party trophy for downsizing government: