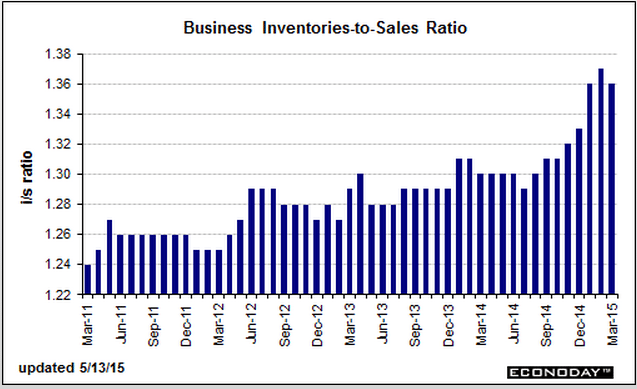

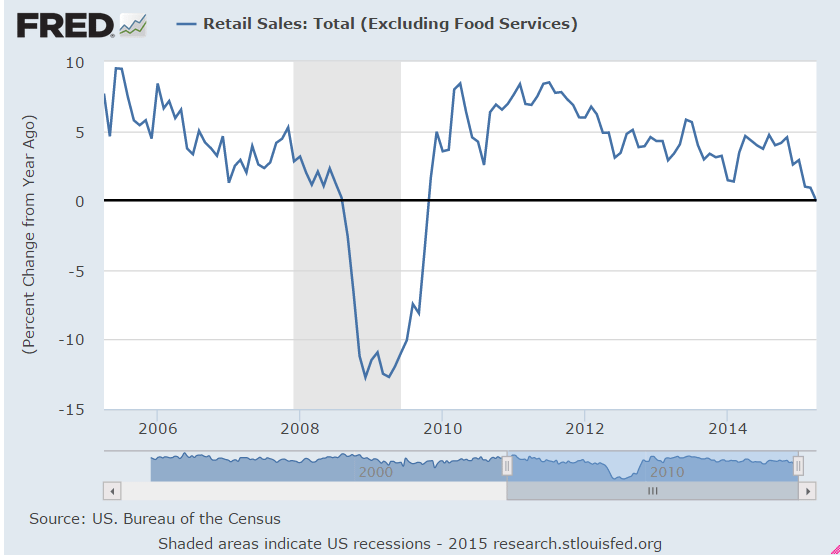

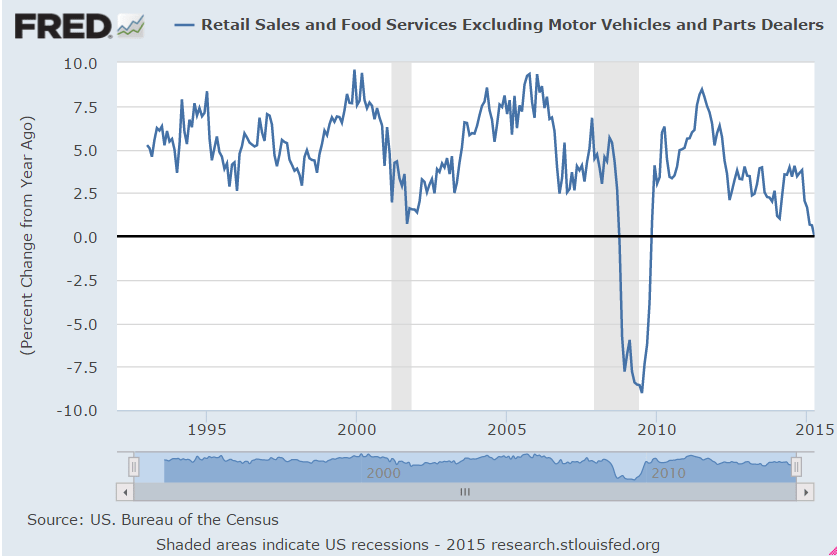

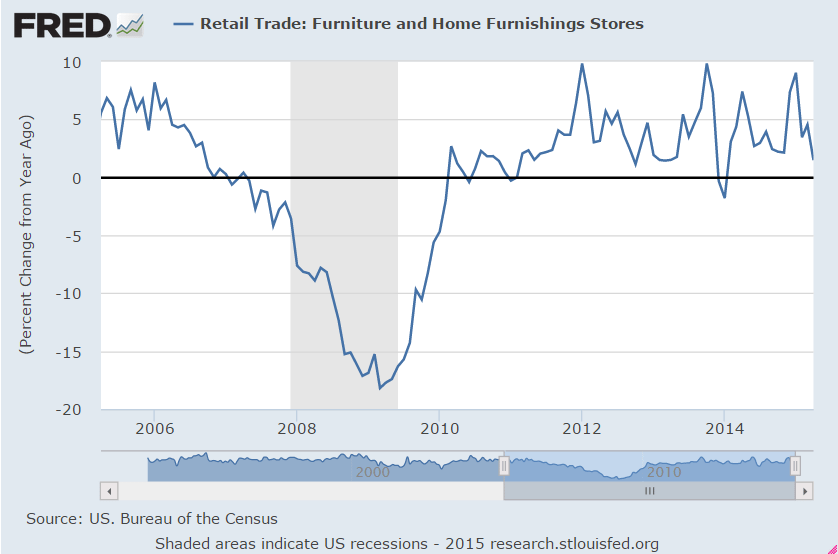

Still way high, especially with today’s retail sales growth at 0

United States : Business Inventories

Highlights

Business inventories don’t look quite as bloated after a small 0.1 percent gain in March that is under the 0.4 percent gain in business sales, taking the stock-to-sales ratio down to 1.36 from February’s recovery high of 1.37.

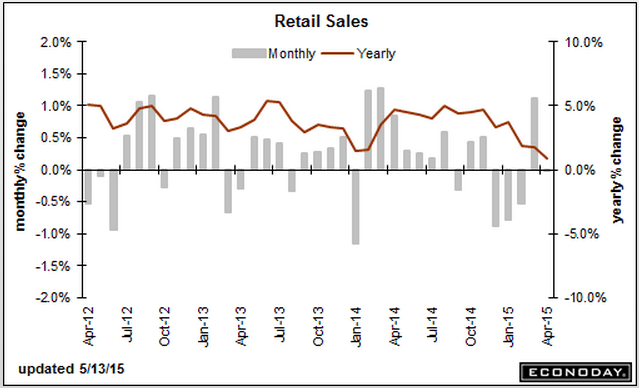

The improvement in March is centered, however, in the retail sector where, thanks to that month’s surge in sales, the stock-to-sales ratio slipped to 1.46 from 1.47. Whether further improvement can be expected in April is uncertain given this morning’s disappointing retail sales report.

The stock-to-sales ratios for the report’s two other components were unchanged, at 1.35 for manufacturers and at 1.30 for wholesalers.

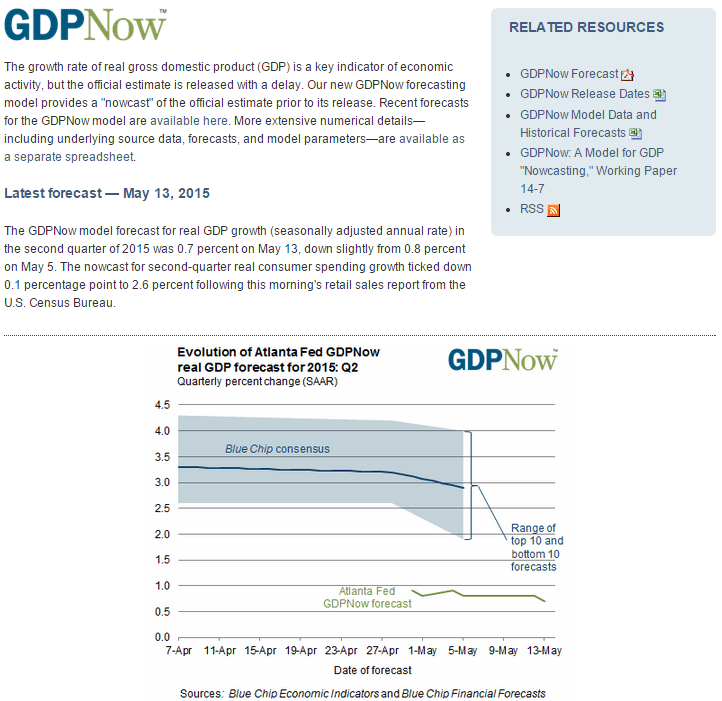

Inventory overhang, built up during the slow first quarter, is widely seen as a risk for second-quarter growth, though this report suggests that the inventory headwind may not be that severe. Today’s data follow yesterday’s small business optimism report where inventory readings were surprisingly low.

Q2 forecast down to .7% as nothing yet stepping up to replace the lost oil and gas capex spending: