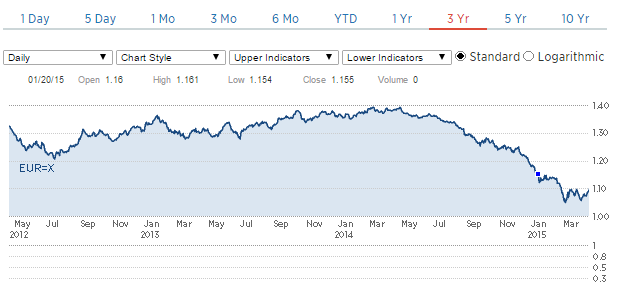

So today, for example, US tsy secs were up in yield yet the dollar went down vs the euro instead of up as it had been doing when US rates went up. So perhaps the CB’s who were selling euro have backed off? Maybe their exporters notices their euro reserves were falling and expressed their concerns? Meanwhile the EU current account surplus continues to increase and ‘drain’ ever more euro from importers of EU goods and services, and the last thing the EU needs now is a strong euro taking away it’s net exports:

Mosler Economics / Modern Monetary Theory

The Site of Economist Warren Mosler