Who would have thought?

Chicago Fed National Activity Index

Highlights

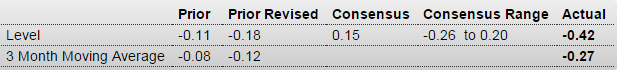

March was not a good month for the economy, an assessment confirmed by the national activity index which fell steeply to minus 0.42 vs an already weak and downwardly revised minus 0.18 in February. And the first quarter as a whole was also weak, reflected in the 3-month average which came in at minus 0.09.

The production component, at minus 0.27, pulled down the index the most in March followed by personal consumption & housing at minus 0.13. Employment also pulled down the index, at minus 0.3 for a big swing downward vs February’s plus 0.11. The only component in positive ground in March, and only barely, was sales/orders/inventories at only plus 0.01.

Imagine what inflation would be without the years of 0 rates, the QE, and the weak euro!

;)

European Union Consumer Prices Fall for Fourth Month

April 17 (WSJ) — Eurostat on Friday said consumer prices in the 28-nation bloc fell 0.1% in March from a year earlier, and confirmed data that showed prices in the eurozone were also 0.1% lower. In February, prices fell 0.3% in the EU as a whole, a figure that was revised from an earlier estimate of 0.2%. Twelve EU members experienced an annual decline in consumer prices in March, down from 20 in February. The decline in prices in the 12 months to March was largely due to a drop in energy costs, although that eased markedly. In the eurozone, energy prices rose 1.7% from February.