US macro update:

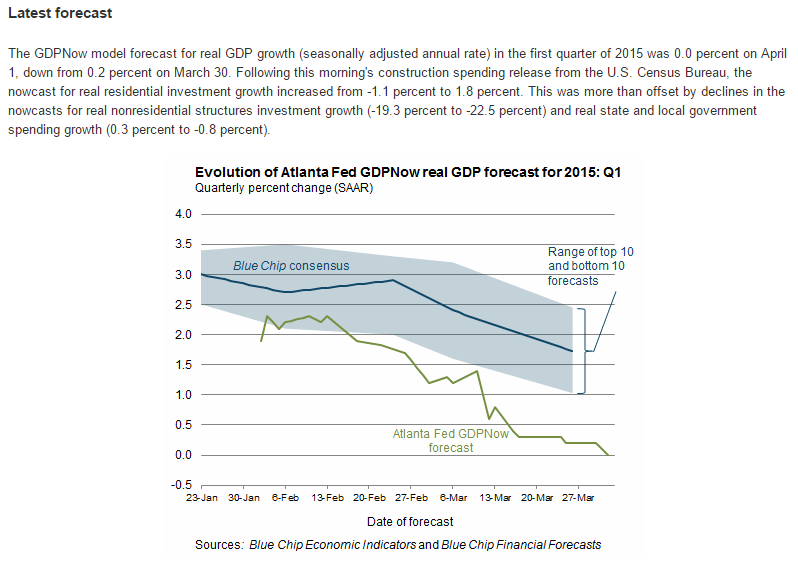

So looks to me like it’s all gone bad since the oil price crash, exactly as feared, and the Atlanta Fed most recently lowered it’s Q1 GDP estimate to 0.

First, a quick review of the accounting.

GDP = spending = sales = income.

An increase in spending = an increase in sales = an increase in income.

And, on a look back, as a point of logic, is this critical, fundamental understanding:

For every agent that spent less than his income (aka demand leakages) another must have spent more than his income (aka deficit spending/spending from savings) or that much output would not have been sold.

And this also means that to sustain last year’s rate of GDP growth, all the sectors on average need to grow at least at the same rate as last year, and higher if GDP growth is to increase.

Next, in that context, a quick look back at the last few years.

When stocks fell after the 2012 Obama reelection I called it a buying opportunity, as I saw sufficient total deficit spending along with sufficient income growth for additional private sector deficit spending that I thought would support maybe 4% GDP growth.

But that changed when we were allowed to at least partially go over what was called ‘the fiscal cliff’ with the expiration of my (another story) FICA tax cut and some of the Bush tax cuts amounting to what was then estimated to be a $180 billion tax hike- the largest in US history. And the sequesters about 4 months later cut about 70 billion in spending. That all lowered my GDP estimate by that much and more, and I began referring to a macro constraint that would keep an ever declining lid on GDP.

The fundamental problem was that govt, the agent that was spending more than its income to offset the demand leakages, had suddenly removed that support, and I didn’t see any other agent stepping up to the plate or even capable of stepping up to the plate to increase his deficit spending to replace it. Historically it would be housing and cars, but with the income cuts from the decrease in govt net spending I didn’t see those sectors sufficiently increasing private sector deficit spending.

So GDP growth was lower than expected in 2013, and even what we had towards the end of the year looked bogus to me, including the mainstream claiming the rise in inventories this time was a good thing, not to be followed by reduced production, as it meant there were high sales forecasts and it all would be self sustaining. I thought otherwise and wrote about heading to negative growth by year end.

And in fact Q1 2014, originally forecast to grow at about 2%, was first released as positive before being subsequently revised down to less than -2%, with maybe 1% of that drop due to cold weather. At that point I continued to not see any source of deficit spending to offset the demand leakages that were dragging down the economy.

However, what I completely missed in early 2014 was the increase in deficit spending underway in the energy sector as new investment chased $90 crude prices. I knew crude production was expanding, and likely to grow by maybe a million barrels/day or so, but I didn’t realize the magnitude of the rate of growth of that capital expenditure until after prices collapsed several months ago and economists started estimating how much capex might be lost with lower prices.

It was then I realized that the energy sector had been the mystery source of the growth of deficit spending that had been offsetting the drop in govt deficit spending, and thereby supporting the positive GDP prints that otherwise might have gone negative much sooner, and that the end of that support was also the end of positive GDP growth.

So here we are, with Q1 GDP forecasts all being revised down after Q4 was also revised down, as all the charts are pointing south, and all are in denial that it is anything more than a random blip down as happened last year in Q1, along with the pictures of houses and cars covered in snow, as forecasts for Q2 and beyond remain well north of 2%.

But without some agent stepping up to the plate to replace the lost growth in energy CAPEX that replaced the lost govt deficit spending, all I can see is the automatic fiscal stabilizers- falling tax revenues and rising unemployment comp- as the next source of deficit spending that eventually reverses the decline.

FX:

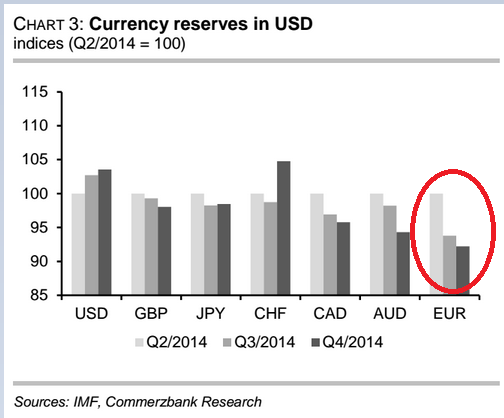

The euro short/underweight looks to me to be the largest short of any kind in the history of the world. The latest reports confirmed large scale global central bank portfolio shifting out of euro both through historically massive active selling, as well as passively as valuations changed relative weightings. And at the same time, the speculation and portfolio shifting that drove the euro down resulted in the real global economy selling local currencies to buy euro to use to purchase real goods and services from the EU. In other words, the falling euro has supported a growing EU current account surplus that’s removing net euro financial assets from the global economy.

The portfolio shifting has been driven by fundamental misconceptions that include the belief that

1. The old belief that lower rates from the ECB are an inflationary bias and therefore euro unfriendly

2. The old belief that QE is an inflationary bias and therefore euro unfriendly

3. The belief that Greek default is euro unfriendly

4. The new belief that the EU current account surplus creates a domestic savings glut that is euro unfriendly.

The operational facts are the opposite:

1. Lower rates paid by govt reduce net euro financial assets in the economy while net govt spending is not allowed to increase, the net of which functionally is a tax on the economy and euro friendly.

2. QE merely shifts the composition of euro deposits at the ECB while (modestly) reducing interest income earned by the economy and increasing ECB profits that get returned to members to contribute to deficit reduction efforts and not get spent, the net of which is functionally a tax on the economy and euro friendly.

3. Greek bonds are euro deposits at the ECB that are reduced by default, thereby acting as a tax on the economy and euro friendly.

4. The EU current account surplus is driving by non residents buying real goods and services from the EU which entails selling their their currencies and buying euro used to make their purchases, which is euro friendly.

So it now looks to me like the portfolio shifting has run its course as the EU current account surplus continues to remove euro from the global economy now caught short. This means the euro is likely to appreciate to the point where the current account surplus reverses, and since the current account surplus is not entirely a function of the level of the euro, that could be a very long way off. Not to mention that as EU exports soften additional measures will likely be taken domestically to lower costs to enhance competitiveness, which will only drive the euro that much higher.