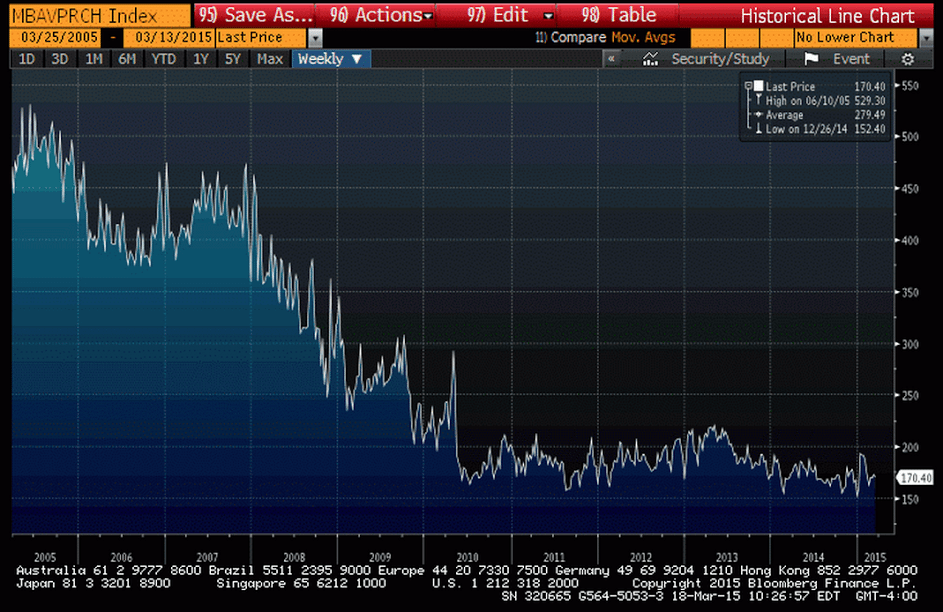

Still no sign of life here:

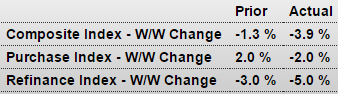

MBA Mortgage Applications

Highlights

Despite low mortgage rates, demand for mortgage purchase applications continues to be weak, down 2.0 percent in the March 13 week for a year-on-year rate of only plus 1.0 percent. Refinance applications fell 5.0 percent in the week. Rates moved lower in the week with the average 30-year mortgage for conforming loans ($417,000 or less) down 2 basis points to 3.99 percent.

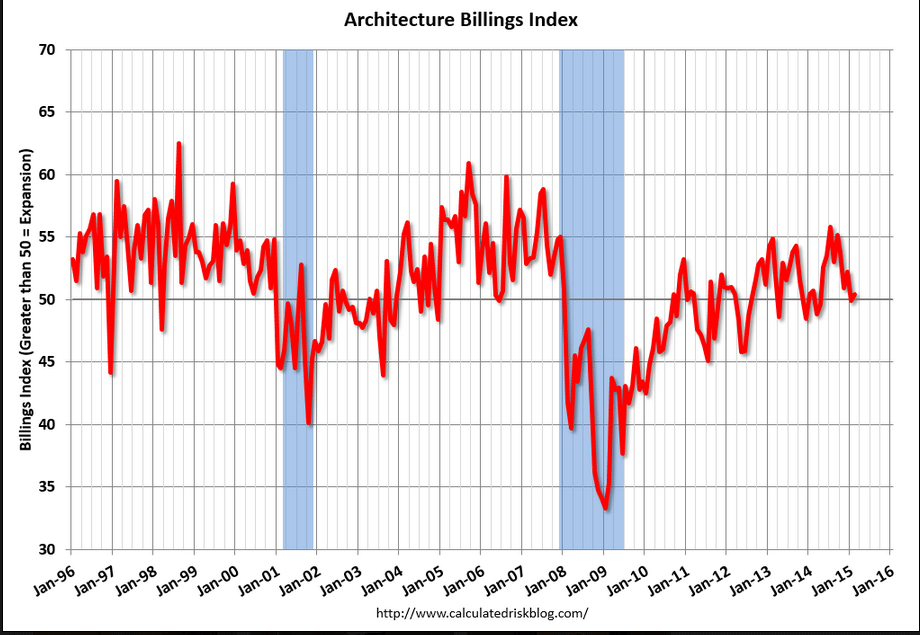

Not looking good here either:

Washington, D.C. – March 18, 2015 – After its first negative score in ten months, the Architecture Billings Index (ABI) showed a nominal increase in design activity in February, and has been positive ten out of the past twelve months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.4, up slightly from a mark of 49.9 in January. This score reflects a minor increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.6, down from a reading of 58.7 the previous month.

More evidence this was the source of credit expansion, now gone, that picked up the slack when taxes were raised and spending cut in 2013. BIS chart on left shows growth of energy sector debt that offset the 2013 tax hikes and spending cuts.

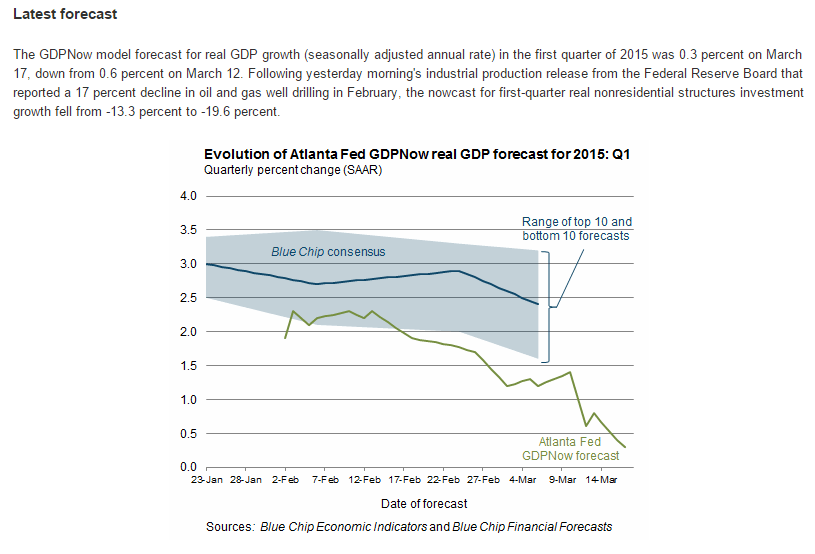

The subsequent cutbacks explains the sudden collapse of US GDP:

Debt in the #oil and gas sector surged to $2.5 trillion last year from $1 trillion in 2006 http://t.co/xxwmCDj5Dp pic.twitter.com/HcnInCF7Jw

— Pedro da Costa (@pdacosta) March 18, 2015

Atlanta Fed GDPnow:

Unless some other agents steps up to spend more than its income GDP growth will not recover, and, as in prior cycles, the ‘automatic fiscal stabilizers’ will do their thing to reduce tax collections and increase transfer payments, thereby increasing the federal deficit in the ensuing slowdown until the deficit gets large enough reverse the downturn and support the next growth cycle.