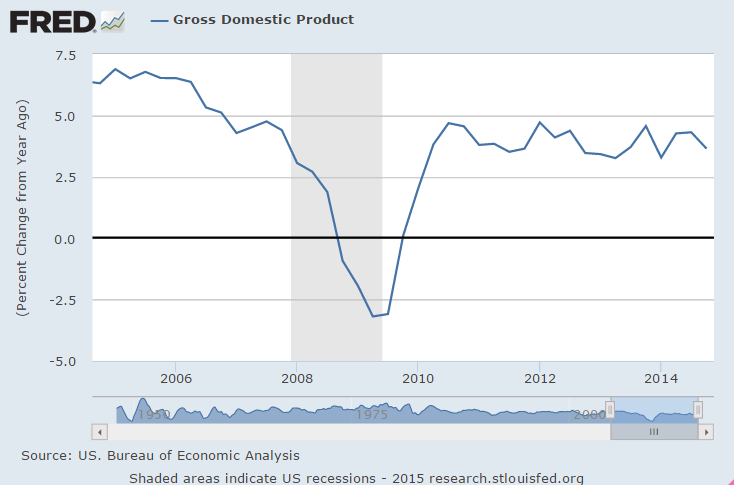

No ‘surge’ happening and Q1 GDP at risk as well from collapse of oil and gas investment:

GDP Growth Slows to 2.2% in 4Q, revised lower but still better than expected

Latest figures indicate breakout pace of growth in the second and third quarters was unsustainable. The latest figures indicate the breakout 5% pace in the third quarter and 4.6% in the second quarter were unsustainable. For 2014 as a whole, GDP expanded 2.4%, slightly better than the average 2.2% growth of 2010-2013. By comparison, the economy grew an average 3.4% a year during the 1990s. Real personal consumption expenditures increased 4.2% in the 4Q, compared with an increase of 3.2% in the 3Q.

This is nominal GDP (not inflation adjusted):

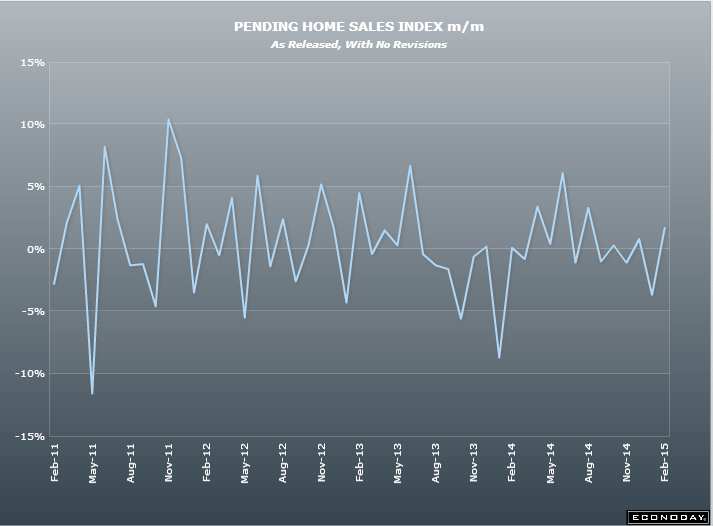

NAR: Pending Home Sales Rise in January to Highest Level in 18 Months, climbed 1.7% to 104.2 in January from an upwardly revised 102.5 in December and is now 8.4% above January 2014 (96.1). Improved buyer demand at the beginning of 2015 pushed pending home sales in January to their highest level since August 2013. All major regions except for the Midwest saw gains in activity in January. NAR chief economist, says “Contract activity is convincingly up compared to a year ago despite comparable inventory levels,” he said. “The difference this year is the positive factors supporting stronger sales, such as slightly improving credit conditions, more jobs and slower price growth.” “All indications point to modest sales gains as we head into the spring buying season,” “However, the pace will greatly depend on how much upward pressure the impact of low inventory will have on home prices. Appreciation anywhere near double-digits isn’t healthy or sustainable in the current economic environment.” Total existing-homes sales in 2015 are forecast to be around 5.26 million, an increase of 6.4% from 2014. The national median existing-home price for all of this year is expected to increase near 5%. In 2014, existing-home sales declined 2.9% and prices rose 5.7%.

Looks to me like a dip and a recovery before and then after mtg rules were altered in Jan.

With the ‘average’ still near 0:

ISM Chicago Business Barometer At 5½-Year Low, Down 13.6 Points to 45.8 in February.

Production, New Orders, Backlogs Suffer Double Digit Declines.

LA port strike being blamed for some of the decline:

U of M Consumer Sentiment fell to 95,4 in February (final) from 98.1 in January.

Consumer optimism was affected by lower gas prices and an unusually harsh winter. The small overall decline from January still left consumer confidence at the highest levels in eight years