Texas drilling permits dropped 50 percent, Railroad Commission reports

By James Osborne

Oil drilling activity in Texas is falling dramatically, as the steep decline in crude prices since the summer takes hold, state regulators reported Tuesday.

The Texas Railroad Commission issued 1,353 permits for oil drilling last month, 50 percent less than it did the previous month. And in the months ahead, that will likely translate to rigs being shut down and layoffs across oil fields in West and South Texas.

“There’s more to come in the months ahead,” said Pavel Molchanov, an energy analyst with Raymond James. “This isn’t pleasant, but this is how the market rebalances itself.”

For now drilling rig counts are holding relatively steady, as companies wind down their contracts. Since peaking in October, the number of drilling rigs operating in the United States has declined by just 5 percent, according to the oil field service company Baker Hughes.

That number should continue a steady decline as companies make the decision to delay drilling on their leased land.

In recent weeks companies including Conoco Phillips and Marathon have both announced their drilling budgets for next year will be 20 percent less than 2014. For smaller companies, which fill out the bulk of the oil field, the reductions are even more dramatic.

Even so, oil production in Texas continues to grow, as existing wells flow and new wells come online. The Railroad Commission reported Texas produced 2.2 millions barrels a day in October, a modest increase from the previous month.

West Texas Intermediate, the U.S. benchmark, closed at $57 Tuesday, down more than 45 percent over the past five months. If that price holds, analysts are predicting U.S. production will continue to grow into mid-2015, at which point it will flatline though to the end of the year.

“2016 depends on what happens to oil prices between now and then. We think prices will be higher a year from now but there’s a lot of moving parts,” Molchanov said.

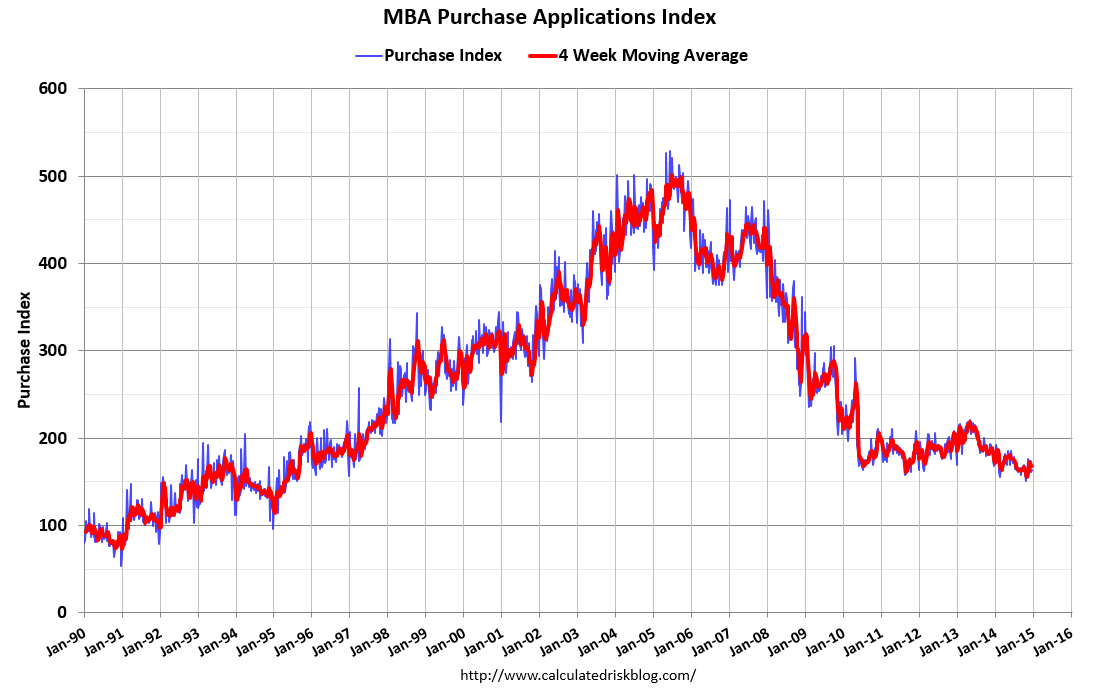

With cash sales down and mtg purchase apps still down year over year seems total sales would be down as well:

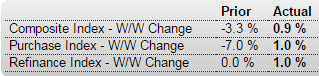

MBA Purchase Applications

Highlights

The purchase index showed a little life in the December 19 week, up 1.0 percent to help lift the year-on-year rate from the negative middle single digits to the low single digits at minus 1.0 percent.

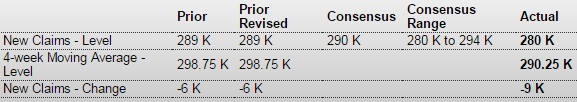

New jobless claims remain low largely as a function of time since the last recession.

We’ll see what happens as oil sector cuts go into effect.

Jobless Claims