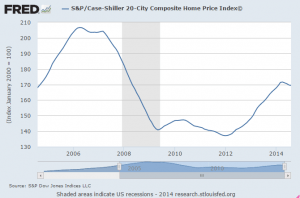

This continuing decline is particularly troubling as cash buyers are also on the decline, and home sales are already at severely depressed levels by any measure.

Furthermore, prices have also been falling month to month, and the year over year gains are heading towards negative territory as well.

This cycle may now be over.

With the federal deficit this low in the context of today’s credit conditions, income lost in one slow period is a drag on the next period, as credit expansion can’t keep up with unspent incomes and it all goes into reverse.

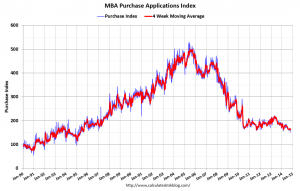

MBA Purchase Applications

Highlights

The big drop this month in mortgage rates has yet to raise demand for purchase applications which, in the October 24 week, fell a sharp 5.0 percent for the second straight week. And the trend for purchase applications is suddenly moving lower with the year-on-year rate, which had been in the low negative double-digits, now at minus 15 percent.

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

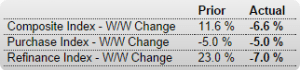

Mortgage applications decreased 6.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 24, 2014. …

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. … The seasonally adjusted purchase index and conventional purchase index were the lowest since February 2014, while the government purchase index was the lowest since August 2007.