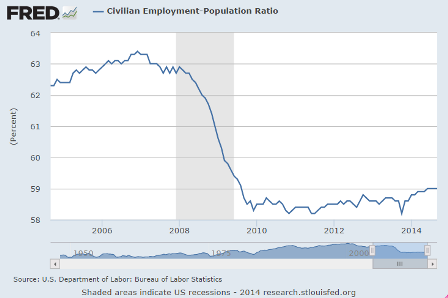

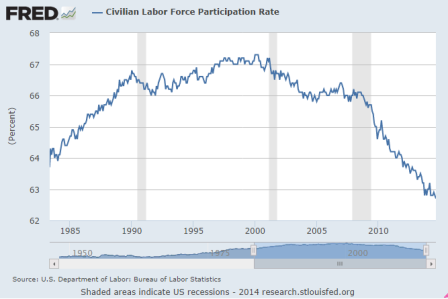

Jobs: Just keeping up with population growth- 59% three months in a row, not at all ‘recovering’ as in prior cycles. So seems the extra jobs are from underestimating population growth?

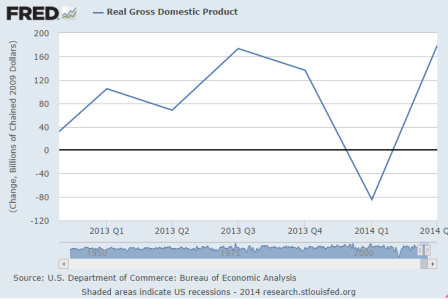

Spending- working its way lower after the tax hikes and sequesters. Q3 201313 was supported by unsold inventories, Q4 13 by expiring tax credits, then down for Q1 2014 as inventories were reduced and cold weather hurt some, and a Q2 bounce that resulted in only 1.2% growth for the first half of this year:

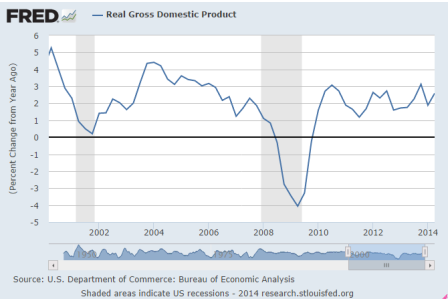

You can see how in the previous cycle the large drop in the growth rate was followed by a rebound to much higher rates of growth. The current cycle saw a much larger decline in GDP that was followed by lower rates of growth that now seem to be further declining:

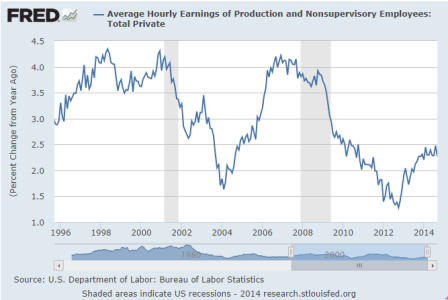

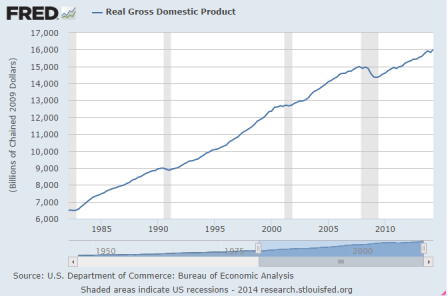

You can see the persistent shift down after the last recession that didn’t happen in prior cycles:

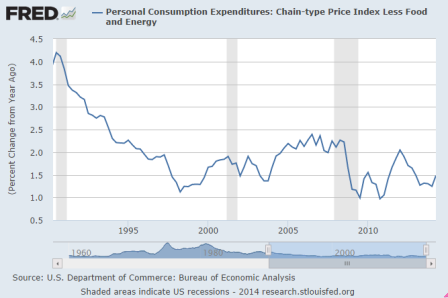

Inflation? 6 years of 0 rates, over 4 trillion of QE, and the Fed still can’t hit it’s 2% target? Maybe it’s not so easy to inflate as most think? And just maybe the Fed has it all backward, and 0 rates and QE are deflationary?

Like the hairdresser said, “no matter how much I cut off its still too short”: