A lot better than expected, and markets reacting accordingly, and the narrative about the 1.2 million people losing benefits at year end ‘inflating’ the jobs number seems not material based on the numbers so far released:

Employment Situation

Highlights

The labor market improved in September for the most part. Job growth topped expectations, The unemployment rate declined. However, wage inflation is oscillating but remaining on a low trajectory.

Nonfarm payroll jobs gained 248,000, after a 180,000 rise in August and 243,000 increase in July. Net revisions for July and August were up a sharp 69,000. The median market forecast for September was for a 215,000 gain.

The unemployment rate declined to 5.9 percent from 6.1 percent in August. Expectations were for 6.1 percent.

Going back to the payroll report, private payrolls advanced 236,000 in September after a 175,000 boost in August. Expectations were for 236,000.

Average hourly earnings were unchanged in September after a 0.3 percent rise the month before. Average weekly hours ticked up to 34.6 hours versus 34.5 hours in August and expectations for 34.5 hours.

Overall, job growth improved while wage inflation remained soft. The Fed still has many options for policy.

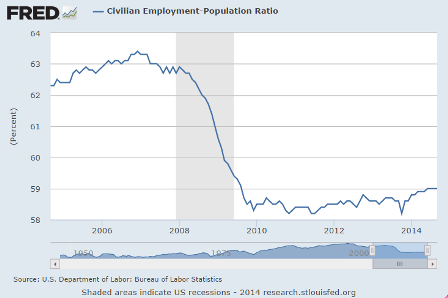

While there were more net new hires, seems the working age population went up quite a bit as well, as the % of the population working remained at relatively low 59% for the third month: