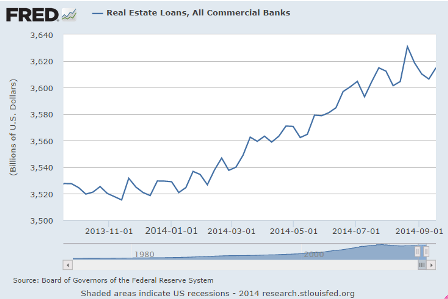

Declines in 7 of 20 largest states not good.

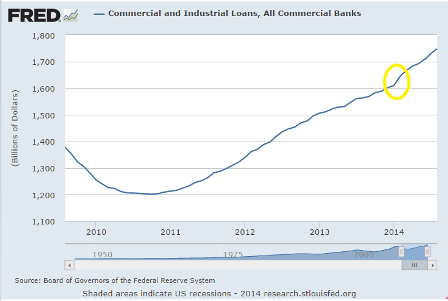

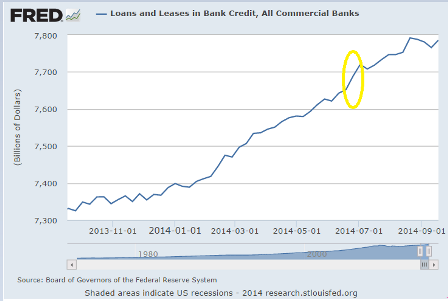

Sure feels to me like this cycle is over:

Full size image

Declines in 7 of 20 largest states not good.

Sure feels to me like this cycle is over:

The much hyped acceleration still looks like it’s over.

Acceleration alarm zones circled in yellow:

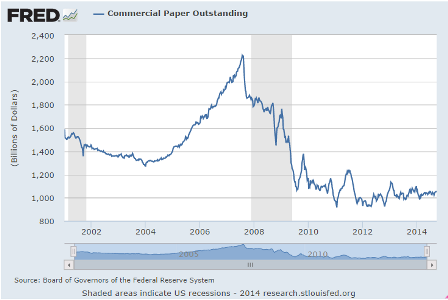

This was a major source of shadow bank funding as well as non financial funding:

Fewer cash buyers and fewer mtg purchase apps also translated into fewer pending home sales:

Pending Home Sales Index

Highlights

The outlook for the used home market remains stubbornly flat, with pending home sales down a disappointing 1.0 percent in August. The Econoday consensus was calling for a 0.8 percent gain. Year-on-year, pending home sales in August were down 2.2 percent which is roughly in line with a 5.3 percent decline for final sales of existing homes in data that were released last week.

A lack of first-time buyers and strong demand for rentals remain key obstacles for home sales. A lack of distressed homes on the market is another negative factor. Mortgage rates for now are still low but are likely to begin to rise as the Fed withdraws stimulus and begins to raise rates, a prospect that points to continued sales weakness ahead.

Regionally, weakness in sales trends for existing homes has been spread evenly with the West lagging slightly. Weakness in today’s report is centered in the Midwest where pending sales fell 2.1 percent for a year-on-year decline of 7.6 percent. The Northeast shows an even steeper 3.0 percent decline in the month though it is the only region with a positive year-on-year rate at plus 1.6 percent. Pending sales rose 2.6 percent in the West though the year-on-year is minus 2.6 percent while the South, which is by far the largest housing region, shows a 1.4 percent decline in the month and no change on the year.

The number of signed contracts to buy existing homes fell 1 percent in August compared to July and is down 2.2 percent from August of 2013, according to the National Association of Realtors

Note that payroll taxes went up Jan 2013, and the sequesters first hit in April, followed by Fed statements that caused mtg rates to gap up about 1% in July or so. We seem to be faltering below the prior 2013 peak and well below prior cycles:

Personal income numbers are not inflation adjusted here:

Highlights

The consumer sector showed improvement in August for both income and spending. Personal income growth posted a 0.3 percent gain in August, following a 0.2 percent rise in July. The latest number matched expectations for a 0.3 percent advance. The wages & salaries component was even stronger with a 0.4 percent boost, following a 0.2 percent increase the month before.

Personal spending jumped 0.5 percent after no change in July. Analysts forecast a 0.5 percent boost. Strength was in the durables component which jumped 1.8 percent after no change in July. August reflected a jump in auto sales. Lower gasoline prices tugged down on nondurables. Nondurable spending declined 0.3 percent after no change in July. Services jumped 0.5 percent in August after being unchanged the month before.

PCE inflation slowed to a monthly no change in August from 0.1 percent in July. The latest figure came in slightly lower than expectations for a 0.1 percent rise. Core PCE inflation posted at 0.1 percent, equaling the pace for July. The median market forecast was for no change.

On a year-ago basis, headline PCE inflation eased to 1.5 percent from 1.6 percent in July. Year-ago core inflation was 1.5 percent in both August and July. Again, PCE inflation remains well the Fed goal of 2 percent but is edging upward.

This is the pre tax personal income: