Weak euro zone lending data underscores need for ECB stimulus

By Eva Taylor

Sept 25 (Reuters) — Lending to euro zone households and companies contracted for the 28th month in a row in August, though at a slower pace, putting a keener spotlight on European Central Bank efforts to get credit flowing again.

Euro zone banks, particularly in the crisis-stricken countries, have tightened up on lending as they adapt to tougher capital requirements and undergo health checks, while companies are holding back on investments, unsure of the future.

The euro zone economy ground to a halt in the second quarter and with inflation in what ECB President Mario Draghi has called the “danger zone” below 1 percent for almost a year now, the ECB saw the need to add new stimulus steps in June and September.

The ECB has now started to offer banks four-year loans at ultra-cheap rates and plans to buy asset-backed securities and covered bonds from October to lighten the weight on banks’ balance sheets and entice them to lend.

But economists in a Reuters poll are skeptical about whether the plan will work, saying bank lending to private euro zone businesses needed to grow at a 3-percent annual rate on a sustained basis to stir inflation.

August lending rates are nowhere near such levels.

In August, loans to the private sector continued to fall, down 1.5 percent from the same month a year earlier after a contraction of 1.6 percent in July, ECB data showed on Thursday. Private sector loans have not grown since April 2012.

“It remains questionable as to how much all the liquidity measures announced by the ECB will encourage banks to lift their lending,” IHS Global Insight economist Howard Archer said.

“…it is also questionable how much businesses’ demand for credit will pick up while the economic and political outlook looks so uncertain,” he said.

WEAK LENDING IN IRELAND

Draghi told Lithuanian business daily Verslo Zinios in an interview published on Thursday a continued weakness in credit growth was likely to curb the euro zone recovery.

Euro zone companies rely mainly on bank funding rather than capital markets, which is why it is so crucial to fix lingering problems in the sector.

For that purpose, the ECB is putting the bloc’s top banks through a thorough review of their balance sheets to weed out bad loans, update collateral valuations and adjust capital.

The picture varies across the euro zone. While lending to companies in Ireland fell at an annual rate of 11.8 percent in August – the fastest decline in three years – and 8.8 percent in Spain, it rose in Finland, Germany and France.

Euro zone M3 money supply – a more general measure of cash in the economy – grew at an annual pace of 2.0 percent in August, up from 1.8 percent in July.

Daily Archives: September 25, 2014 @ 4:29 pm (Thursday)

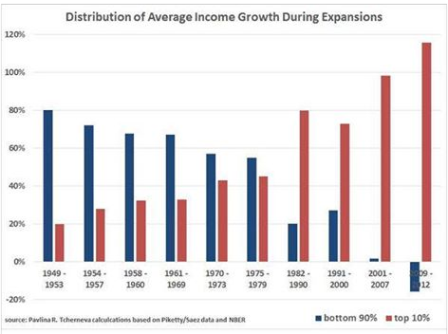

Chart from Pavlina Tcherneva

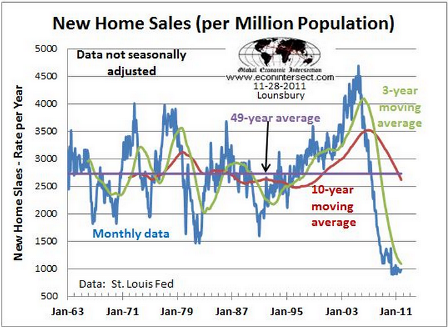

New home sales

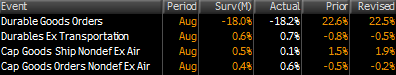

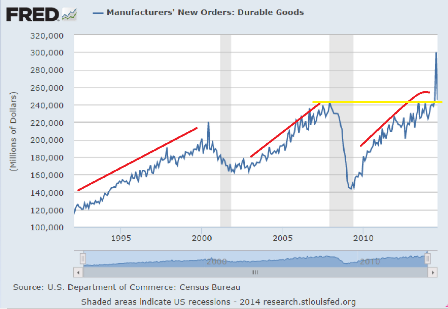

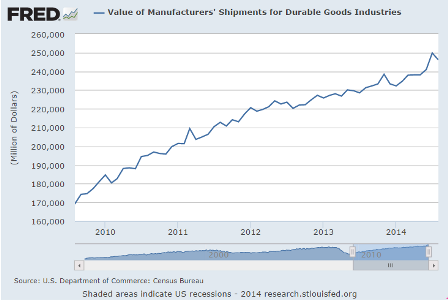

Durable Goods orders

Durable Goods Orders

Highlights

Durables orders fell back in August, coming off July’s surge in aircraft orders. But the core was healthy in August. New factory orders for durables dropped a monthly 18.2 percent, following a spike of 22.5 percent in July. Market expectations were for a 17.1 percent fall. Transportation fell a monthly 42.0 percent in August, following a 73.3 percent jump the month before.

Excluding transportation, durables orders rebounded 0.7 percent, following a decline of 0.5 percent in July. Analysts projected a 0.8 percent gain for August.

Within transportation, nondefense aircraft fell a monthly 74.3 percent, following a 315.6 percent spike in July with both swings essentially reflecting Boeing aircraft orders. Defense aircraft orders slipped 0.6 percent, following a 31.7 percent drop in July. Motor vehicle orders have been moderately volatile but healthy on average, decreasing 6.4 percent after a 10.0 percent boost the prior month.

Outside of transportation, major industries seeing a gain in the latest month were fabricated metals, machinery, computers & electronics, electrical equipment, and “other.” Declines were posted for primary metals.

Orders for equipment investment made a healthy comeback in August. Nondefense capital goods orders excluding aircraft rebounded 0.6 percent in August, following a dip of 0.2 percent the month before. Shipments of this series edged up 0.1 percent but followed a strong 1.9 percent gain in July.

Recent durables orders have shown record volatility. On average, durables orders point to moderate upward momentum in manufacturing.

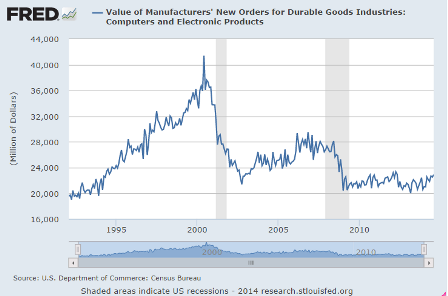

The yellow line is to show that actual orders have just gotten back to pre recession levels, and that’s not inflation adjusted, so in real terms they haven’t yet caught up.

The red lines are roughly the ‘slope’ which is a proxy for the rate of growth, but it should get ever steeper on this arithmetic chart to indicate the same rate of growth. So the growth rate in this cycle is slowing. And also seems last time around we went into recession before this indicator turned south, while the cycle before that it turned down before we went into recession.

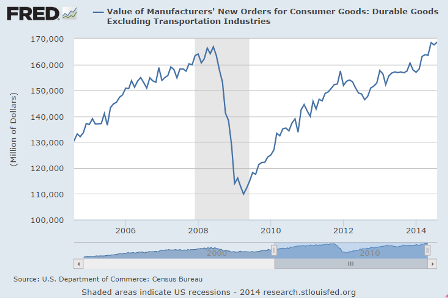

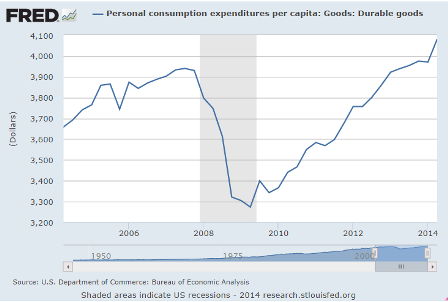

Adjusted for inflation this is still below 2008 levels as well:

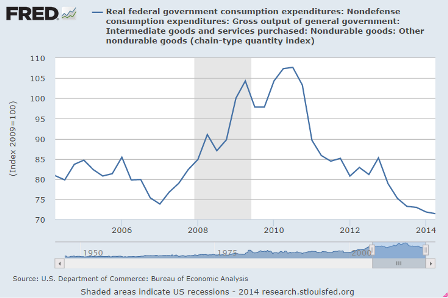

Govt cutbacks in evidence here:

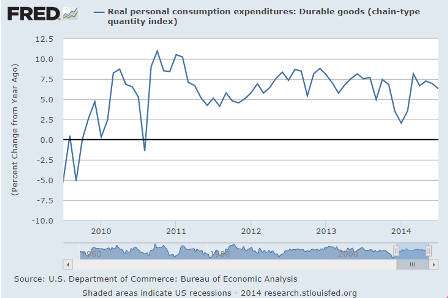

Shipments are what counts for GDP. Last month’s gain increased GDP estimates, this month’s reduction reduces them:

And how about that Y2K/.com mania of the late 90’s!