Maybe some evidence the 1.2 million who lost benefits at year end and took menial jobs phenomenon has run its course, and H2 will show substantially lower employment growth than H1?

When it was going up it was ‘accelerating’, so now it must be ‘decelerating’, right?

Hardly!

Mark Zandi, chief economist of Moody’s Analytics, said, “Steady as she goes in the job market. Businesses continue to hire at a solid pace. Job gains are broad based across industries and company sizes. At the current pace of job growth the economy will return to full employment by the end of 2016.”

Productivity and unit labor cost also figure into employment.

Higher unit labor costs and lower productivity can be a sign sales are falling and headcount is too high:

The current account continues to modestly narrow as a % of GDP, which supports GDP some but not a lot.

Not withstanding that it represents a reduction in real terms of trade/standard of living, of course.

International Trade

The trade deficit in July shrank marginally to $40.5 billion from $40.8 billion in June,

Exports rose 0.9 percent in July after no change the month before. Imports gained 0.7 percent, following a 1.1 percent drop in June.

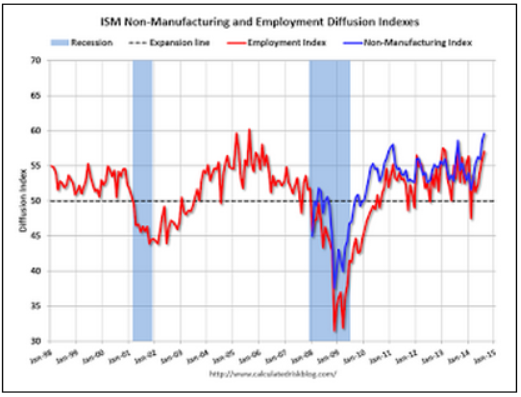

ISM Non-Mfg Index

Highlights

The ISM’s non-manufacturing sample is reporting extending acceleration in composite activity with the index rising 0.9 points to 59.6 from an already very strong 58.7 in July. The August reading is near the top end of the Econoday consensus.

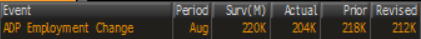

The gain is led by the business index which rose 2.6 points to 65.0 in a reading that indicates exceptionally strong output. Employment is also a big plus, up 1.1 points to 57.1. This gain may offset to a small degree this morning’s weakness in ADP’s estimate for Friday’s jobs report.

One reading is not so positive and that’s new orders. Though coming in at 63.8, the rate of growth is down 1.1 points from July’s 64.9. Other readings include a slowing for supplier deliveries which is in line with the general rise in activity. Pressures on input prices slowed 3.2 points to 57.7 which is moderate for this reading.

Full size image

Full size image

And this housing report:

From housing economist Tom Lawler: Toll Brothers: Net Home Orders Down, Price Gains on Orders Slows; Some “Lessening” in Pricing Power but No “Need” to Increase Incentives Much — Yet

Toll Brothers, the self-described “nation’s leading builder of luxury homes,” reported that net home orders in the quarter ended July 31, 2014 totaled 1,324, down 5.8% from the comparable quarter of 2013. Net orders per community last quarter were down 15.9% from the comparable quarter of 2013. The company average net order price last quarter was $717,000, up 1.4% from a year ago. Toll’s sales cancellation rate, expressed as a % of gross orders, was 6.6% last quarter, up from 4.6% in the comparable quarter of 2013. Home deliveries last quarter totaled 1,364, up 36.8% from the comparable quarter of 2013, at an average sales price of $732,000, up 12.4% from a year ago. The company’s order backlog at the end of July was 4,204, up 5.1% from last July, at an average order price of $737,300, up 4.1% from a year ago. The company controlled 49,037 home sites at the end of July, up 3.9% from last July and up 25.1% from two years ago.

For its “traditional” home building business (i.e., ex city living), net home orders totaled 1,281 last quarter, down 5.0% from the comparable quarter of 2014, at an average net order price of $700,500, up 3.4% from a year ago.