Prior months revised down as well:

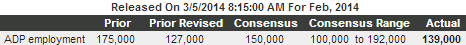

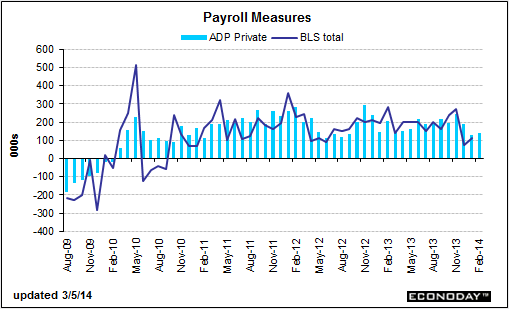

ADP:

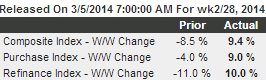

MBA Purchase Applications:

Highlights

Wild swings appear to be the rule for weekly mortgage application data. The purchase index jumped 9.0 percent in the February 28 week following declines of 4.0 percent and 6.0 percent in the two prior weeks. Though the latest week is higher, the year-on-year rate fell 4.0 percentage points to minus 19 percent. The refinance index jumped 10.0 percent in the week following an 11.0 percent decline in the prior week.

The latest week got a lift from a drop in mortgage rates, down 6 basis points for 30-year conforming mortgages ($417,500) to an average 4.47 percent.

It’s hard to make much of this report, but the year-on-year rate for purchase applications does point to continued weakness for home sales.

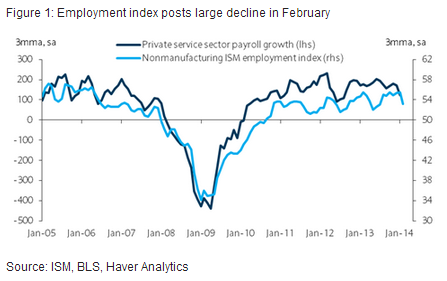

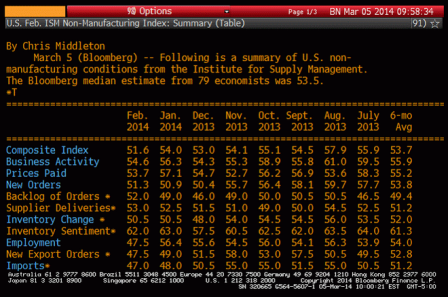

In particular, there was a significant drop in the employment index, which plunged 8.9 points to 47.5. This is its lowest level since 2010 and commentary from respondents suggests that some of this effect could be due to the implementation of the Affordable Care Act.

Outside of the employment index, however, the new orders index climbed to 51.3 (previous: 50.9), and the headline index has now remained above the breakeven level of 50 for 49 consecutive months. Overall we would suggest that this is a softer report than January, but we do not yet think that it marks a significant slowdown in the pace of nonmanufacturing activity growth.

Note export orders down again.

Forecasters have been counting on an increase in export growth:

Full size image

Lawler on Hovnanian: Net Home Orders Far Short of Expectations; Sales Incentives Coming

By Bill McBride

March 5 — From housing economist Tom Lawler:

Hovnanian Enterprises, the nations sixth largest home builder in 2012, reported that net home orders (including unconsolidated joint ventures) in the quarter ended January 31, 2014 totaled 1,202, down 10.6% from the comparable quarter of 2013. The companys sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, up from 17% a year ago. Home deliveries last quarter totaled 1,138, down 4.2% from the comparable quarter of 2013, at an average sales price of $351,279, up 6.1% from a year ago. The companys order backlog at the end of January was 2,438, up 6.0% from last January, at an average order price of $368,243, up 4.3% from a year ago.

Hovnanians net orders in California plunged by 43.4% compared to a year ago. Hovnanians average net order price in California last quarter was $653,366, up 46.8% from a year ago and up 83.2% from two years ago. Net orders in the Southwest were down 10.0% YOY.

Here is an excerpt from the companys press release.“While our first quarter is always the slowest seasonal period for net contracts, the strong recovery trajectory from the spring selling season of 2013 has softened on a year-over-year basis. Net contracts in the months of December, January and February have not met our expectations. In addition to the lull in sales momentum, both sales and deliveries were impacted by poor weather conditions and deliveries were further impacted by shortages in labor and certain materials in some markets that have extended cycle times,” stated Ara K. Hovnanian, Chairman of the Board, President and Chief Executive Officer.

“We are encouraged by the fact that we have a higher contract backlog, gross margin and community count than we did at the same point in time last year. Furthermore, we have taken steps to spur additional sales in the spring selling season, including the launch of Big Deal Days, a national sales campaign during the month of March. Our first quarter has always been the slowest seasonal period and we expect to report stronger results as the year progresses. We believe this is a temporary pause in the industry’s recovery, and based on the level of housing starts across the country, we continue to believe the homebuilding industry is still in the early stages of recovery,” concluded Mr. Hovnanian.