Still tame (with a hint of moving up some) particularly in comparison to the last cycle which was considered relatively tame:

Personal Consumption had a nice spike up in November:

But without the income to sustain it? (Ignore the latest yoy data point ‘dip’ as it’s from the spike a year ago. Just look at the last few monthly data points)

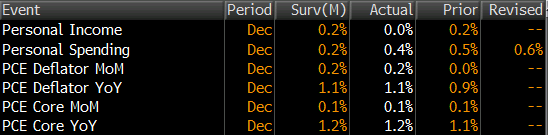

Highlights

Personal income was flat in December while spending was up. Income sluggishness may have been weather related. Personal income was unchanged after rising 0.2 percent in November. Markets expected a 0.2 percent rise. The wages & salaries component posted flat in December, following a 0.5 percent boost the month before.

Personal spending, however, was moderately strong, rising 0.4 percent after a 0.6 percent boost in November. Spending was led by a 1.5 percent jump in nondurables with services gaining 0.4 percent. Durables declined 1.8 percent after a 1.8 percent increase the month before.

The rise in personal consumption was not just price related. Real spending increased 0.2 percent in December after an increase of 0.6 percent in November.

Meanwhile, Saudi oil output, which indicates the net demand for global crude, keeps them in the sweet spot as swing producer/price setter:

Full size image