Highlights

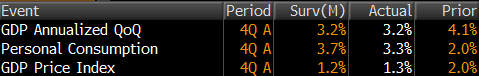

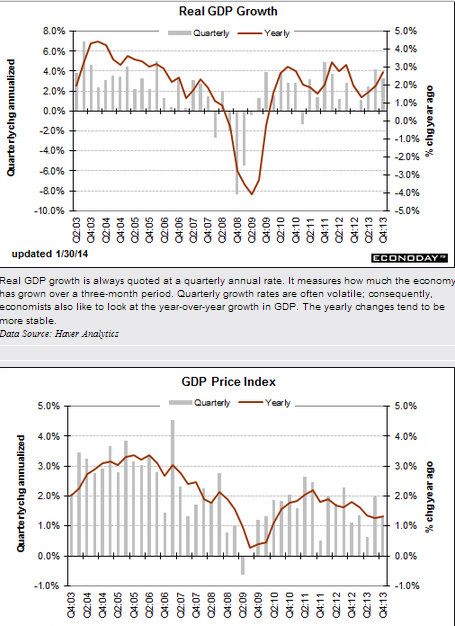

The economy ended the year on a moderately positive note, rising an annualized 3.2 percent in the advance estimate for the fourth quarter. This followed a 4.1 percent boost in the third quarter. The consensus expected a 3.0 percent rise in the fourth quarter.

But demand was not as strong. Final sales of domestic demand gained 2.8 percent after a 2.5 percent boost in the third quarter. Final sales to domestic purchasers slowed to 1.4 percent in the fourth quarter after a 2.3 percent increase the prior quarter. The softening was largely due to a drop in government purchases. A positive was improvement in consumer spending.

Inflation is soft with the GDP price index rising only 1.3 percent after a 2.0 percent increase in the third quarter. The core price index eased to 1.7 percent, following a 1.9 rise in the third quarter.

Highlights

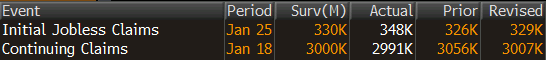

A surprise 19,000 rise in initial jobless to a much higher-than-expected 348,000, together with a rising trend for continuing claims, are not pointing to much improvement for the labor market, at least for January. But a plus in the data is the 4-week average for initial claims, up only slightly to 333,000 which is more than 20,000 below the month-ago trend.

Another plus is a 16,000 dip in continuing claims to 2.991 million in data for the January 18 week. The 4-week average, however, is up sharply, 43,000 higher to 2.970 million which is the highest reading since August. The unemployment rate for insured workers, which had been as low as 2.1 percent in November, is at 2.3 percent for a 3rd straight week.

There are no special factors at play in today’s report though the latest initial claims are for the shortened Martin Luther King week which raises the risk of adjustment volatility. The Fed yesterday cited improvement underway in the labor market but its hard to find convincing proof in this report.