Slow down! We have too many cars: AutoNation CEO

Automakers should watch their bloated inventories even though 2014 seems like it will be a good year for car sales, AutoNation Chairman and CEO Mike Jackson told CNBC on Thursday.

The automakers have a “pretty bizarre” way of calculating inventories to justify these levels, he said in a “Squawk Box” interview. “But if you cut through the bogus calculations and look at dealer inventory for the Detroit 3, it’s over a 100-day supply. And it simply doesn’t need to be there.”

In response, Joe Hinrichs president of the Americas at Fordtold CNBC: “We have been cutting some production in the fourth quarter of last year and in the first quarter of this year on a couple of our product lines where we saw the inventory grow a little bit.”

But Hinrichs added, “The industry is a little different now. With our capacity running max out, we actually grow an inventory in the winter, come down in the spring and summer because we run our plants full all year round. In the old days when we had excess capacity, we’d take the plants down in the winter and work overtime in the spring/summer to supply to the demand.”

He added: “We’re watching it carefully, but I think we’re going to be OK.”

Daily Archives: January 30, 2014 @ 3:15 pm (Thursday)

Turkey’s Prime Minister on rates and inflation

Turkey’s central bank prepared to tighten policy further

“Mr Erdogans own resistance to interest rate rises goes deep: on the flight, the prime minister insisted that, contrary to economic theory, increases in interest rates cause inflation. I believe that inflation and interest rates are not inversely proportional but in direct proportion, he told reporters. In other words, the relationship between inflation and interest is cause and effect: the interest rate is the cause, inflation is the result. If you increase the rate, inflation increases. If you reduce it, both drop together. When you think they are inversely proportional you always get much more negative results.

GDP and unemployment claims charts

Highlights

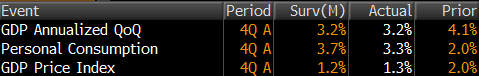

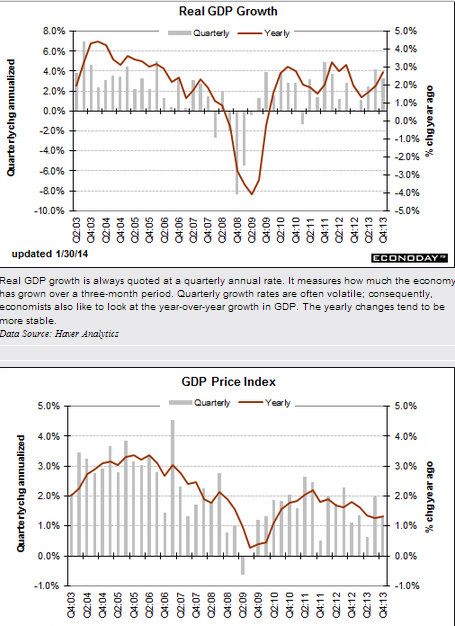

The economy ended the year on a moderately positive note, rising an annualized 3.2 percent in the advance estimate for the fourth quarter. This followed a 4.1 percent boost in the third quarter. The consensus expected a 3.0 percent rise in the fourth quarter.

But demand was not as strong. Final sales of domestic demand gained 2.8 percent after a 2.5 percent boost in the third quarter. Final sales to domestic purchasers slowed to 1.4 percent in the fourth quarter after a 2.3 percent increase the prior quarter. The softening was largely due to a drop in government purchases. A positive was improvement in consumer spending.

Inflation is soft with the GDP price index rising only 1.3 percent after a 2.0 percent increase in the third quarter. The core price index eased to 1.7 percent, following a 1.9 rise in the third quarter.

Highlights

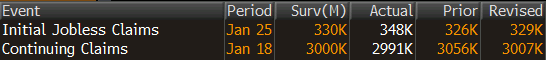

A surprise 19,000 rise in initial jobless to a much higher-than-expected 348,000, together with a rising trend for continuing claims, are not pointing to much improvement for the labor market, at least for January. But a plus in the data is the 4-week average for initial claims, up only slightly to 333,000 which is more than 20,000 below the month-ago trend.

Another plus is a 16,000 dip in continuing claims to 2.991 million in data for the January 18 week. The 4-week average, however, is up sharply, 43,000 higher to 2.970 million which is the highest reading since August. The unemployment rate for insured workers, which had been as low as 2.1 percent in November, is at 2.3 percent for a 3rd straight week.

There are no special factors at play in today’s report though the latest initial claims are for the shortened Martin Luther King week which raises the risk of adjustment volatility. The Fed yesterday cited improvement underway in the labor market but its hard to find convincing proof in this report.