First, factory orders

Always boring

;)

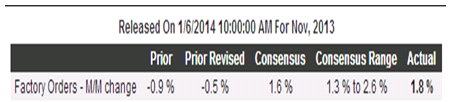

Factory Orders

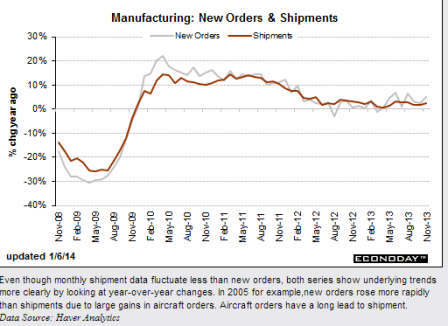

Solid domestic demand together with solid foreign markets appear to be giving a lift to the factory sector with factory orders up a very strong 1.8 percent in November. Another plus is a 4 tenths upward revision to October, to minus 0.5 percent. September orders are unrevised and very strong at plus 1.8 percent like November.

Excluding transportation, orders rose 0.6 percent in November vs an upward revised 0.1 percent gain in October. Orders for capital goods show a big surge, possibly boosted by year-end tax issues but also perhaps by rising business confidence.

Shipments were very strong in November, up 1.0 percent following incremental 0.1 percent gains in the two prior months. And there seems to be no risk of inventory overhang as inventories were unchanged to bring down the inventory/shipments ratio to 1.28 from 1.29.

Unfilled orders are a special plus, jumping 1.0 percent for an 8th straight gain. Last week’s ISM report, boosted by strength in construction-related and auto-related industries, points to another strong month in December for manufacturing which is once again a leading strength for the nation’s economy.

Full size image

ISM non manufacturing

Always more interesting

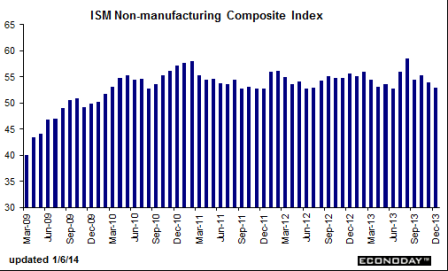

Downward slope since the peak a few months back has continued

Enough said…

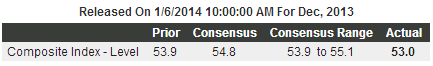

New orders moved suddenly into reverse for ISM’s non-manufacturing sample, pulling down the index which fell 9 tenths to 53.0. New orders, the leading indicator in this report, fell to 49.4 from 56.4 in November. This is the first sub-50 reading for new orders, which had been especially strong through much of the second half of last year, since July 2009.

But coincidental and lagging indications are positive including a steady reading for business activity and a big bounce back for employment, up 3.3 points to 55.8.

Other readings include a second straight contraction for backlog orders, a slight rise for input price pressures, and a slowing in export orders.

Today’s employment reading may lift expectations for Friday’s employment report but otherwise the report hints at an early 2014 slowdown for the economy.

Full size image