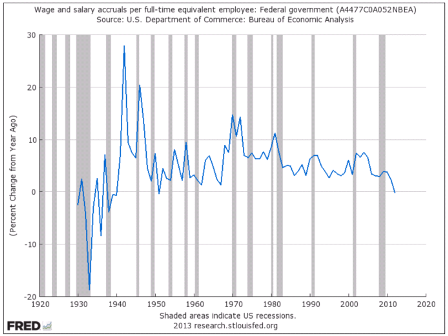

Back in November my forecast for 2013 was 4%, which at the time was by far the highest around. The govt was spending more than its income by about 6% of GDP, which was about $900 billion if I recall correctly. But then it cut back, first with the year end FICA hike along with other expiring tax cuts, and then with the sequesters that began in April.

Consequently, the govt spent only about $680 billion more than its income, which lowered growth by maybe 2%. And today mainstream economists are saying much the same- growth would have been maybe 2% higher without the ‘fiscal drag’ of the tax hikes and spending cuts.

So far our narratives are the same.

But here’s where they begin to differ.

They say the GDP/private sector would have grown by 4% if the fiscal drag hadn’t taken away 2%, and so without the govt again taking away 2%, the private sector will resume its ‘underlying’ 4% rate of growth.

I say the GDP/private sector would have grown by 4% that included the 6%/$900 billion net spending contribution by govt, if govt hadn’t cut back that contribution to $600 billion.

That is, they say the govt ‘took away’ from the ‘underlying’ 4% growth rate, and I say the govt ‘failed to add’ to the ‘underlying’ 2% growth rate that still included a 4% contribution by net govt spending.

And, in fact, I say that if the govt had cut its deficit another 4% to 0, GDP growth might have been -2% (multipliers aside for purposes of this discussion), which is the actual ‘underlying’ private sector growth rate. And that’s due to the ‘unspent income’ of some agents not being sufficiently offset by other agents ‘spending more than their income’.

Furthermore, I say that unless the ‘borrowing to spend’ of the ‘non govt’ sectors steps up to the plate to ‘replace’ the reduced govt contribution, the output won’t get sold, as evidenced by unsold inventory and declining sales in general, throwing GDP growth into reverse, etc.

So because we have different narratives, we read the same data differently.

They see the 1.7% Q3 inventory build as anticipation of future sales, while I see it as evidence of a lack of demand.

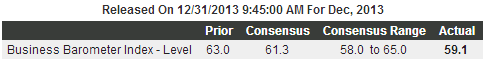

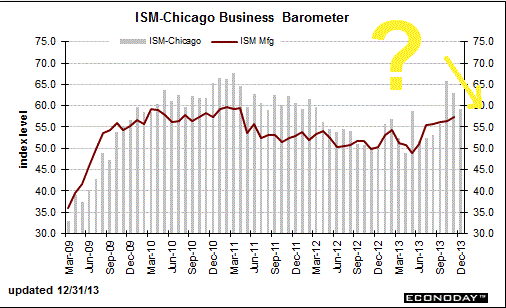

They see the Chicago PMI’s large spike followed by 2 months of decline as a strong 3 month period, while I see it as a sharp fall off after the inventory build.

They see the fall off in mortgage purchase apps as a temporary pause, while I see it as a disturbing fall off in the critical ‘borrowing to spend’ growth maths.

They see October’s shut down limited 15.2 million rate of car sales followed by November’s spike to 16.4 million as a return of growth, while I see the two month average a sign that growth has flattened in this critical ‘borrowing to spend’ dynamic.

And likewise with the weakness in the Pending Home Sales, Credit Manager’s Index, Architectural billings, down then up durable goods releases, new home sales, the slowing rate of growth of corporate profits, personal income, etc. etc.

And they see positive survey responses as signs of improvement, while I see them as signs they all believe the mainstream forecasts.

;)

And not to forget they see the increase in jobs as evidence of solid growth given the rapidly growing % of sloths, and I see it flat as a % of the population.

;)

Happy New Year/ La Shona Tova to all!!!