Seriously!

:(

By Dhara Ranasinghe

July 22 (Bloomberg) — If Japan’s Prime Minister Shinzo Abe, riding high on Sunday’s election victory for his ruling coalition, is serious about transforming the economy, it’s crucial that he pushes ahead with plans to raise a controversial consumption tax, analysts say.

The tax on goods and services, under the current law, is due to rise to 8 percent next April from 5 percent and to 10 percent in 2015, although there has been a heated debated within the government as to whether this should happen.

On the one hand a consumption tax is seen as a key measure to improving Japan’s fiscal health. Japan, the world’s third biggest economy, has a debt pile that is the highest among industrialized nations and its debt-to-GDP ratio is expected to top 245 percent this year.

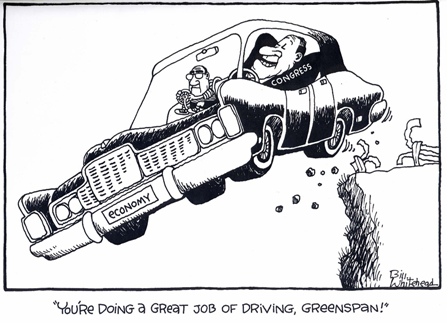

But on the other hand, the tax could hurt consumer spending and stifle the economic recovery Abe is trying to engineer through a mix of fiscal spending and aggressive monetary stimulus.

“The decision on whether to raise the sales tax as early as next April is a finely balanced one with significant implications – both for the economy and for the perceived credibility of Abenomics,” said Nicholas Spiro, managing director at Spiro Sovereign Strategy.

“The last consumption tax increase in Japan ended in disaster, helping trigger a recession. Yet if Mr Abe puts it off, doubts about the fiscal credibility of his project will grow, potentially spooking the bond market,” he added