Americans are not saving enough for retirement, which is a bigger issue than tax policy, Fink said.

Daily Archives: May 29, 2013 @ 8:38 pm (Wednesday)

Noyer Says Not Convinced About Merit of Negative Rates

No mention that it’s a tax

Noyer Says Not Convinced About Merit of Negative Rates

By: Hans Nichols and Mike Dorning

May 29 (Bloomberg) — European Central Bank Governing Council member Christian Noyer said he’s not convinced about the merits of a negative deposit rate as policy makers debate how to revive a moribund euro-area economy.

“We have prepared so that in case of a need we could implement it,” Noyer said in an interview with Bloomberg Television in Paris yesterday. “This is technically very delicate. I’m personally not convinced there’s an interest in doing that.”

The ECB cut its benchmark rate to a record low of 0.5 percent on May 2 and President Mario Draghi signaled the central bank is ready to reduce borrowing costs further if needed. Noyer said a negative deposit rate — which would mean lenders would pay to park excess cash with the ECB — might prompt institutions to raise their lending rates to offset that cost.

“There have been experiences in the past,” he said. “Not all are convincing. In some cases it even tended to trigger an increase in the rates of credit because the banks were compensating for a loss they were getting on their deposits with the central bank.”

Such an outcome would undermine one of the ECB’s main goals, which is to revive lending by banks ravaged by a debt crisis now in its fourth year. The euro-area economy shrank 0.2 percent in the three months through March, a sixth straight contraction. Lending to households and companies fell for a 12th month in April on an annual basis, the ECB said today.

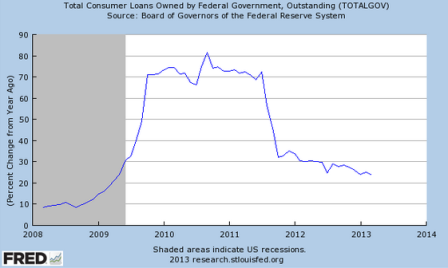

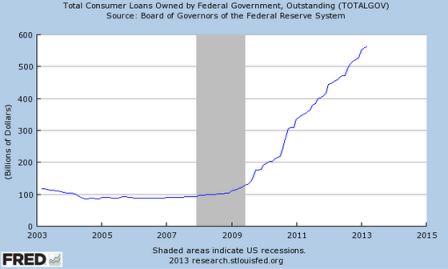

Student Loan FRED Graph

The growth rate of student loans is still high, but decelerating.

It’s still a bit over .5% of GDP each year, but that % is falling as well.

(still searching for the source of credit expansion that’s going to drive GDP in Q2)

Full size image

Full size image

Tweet from John Carney (@carney)

Redbook sales continue to look anemic

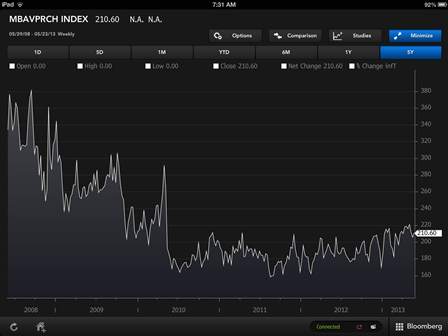

Mtg purchase applications

S&P earnings forecast

From Morgan Stanley:

Interestingly, US corporate earnings that have been growing faster than China’s for the last 18 months are now not. S&P earnings growth is now 2% YoY vs China at 4% YoY and we think that this widens to 0% and 12% growth by year-end.

Obama Accepting Sequestration as Deficit Shrinks

President Barack Obama has stopped worrying and learned to live with sequestration.

By Mark Deen

May 27 (Bloomberg) — Gone are the cold February predictions of mass layoffs, family upheaval and the prospect of a new recession because of the automatic, across-the-board spending cuts. Cabinet secretaries no longer visit the White House briefing room to offer dire forecasts about teacher firings or unsecured borders.

With the economy growing, unemployment falling, Republicans unmoved in resisting tax increases and little sign of the public backlash the White House expected, Obama is adjusting to the spending curbs he once derided as “just dumb.” Attacks on sequestration have receded as a major theme of his speeches.

“He probably has concluded that he can’t change it,” said Stan Greenberg, a Democrat who was a pollster for former President Bill Clinton. “He’s moved away from it because he thinks it’s giving Republicans leverage by focusing on it.”

As the president’s criticism of sequestration wanes, so do prospects for a budget deal big enough to address the U.S.’s long-term fiscal debt, a goal central to helping cement Obama’s legacy that has eluded him since midway through his first term.

Sequestration was designed to be so intolerable to both Republicans and Democrats that the parties would be motivated to reach a broad budget accord to avert the cuts, which would slash spending by $1.2 trillion over nine years. Republicans were supposed to come to the table to stop reductions in defense outlays — which are targeted for about half the cuts — and Democrats to restore funding for domestic programs such as special education, jobless benefits and medical research.