Full size image

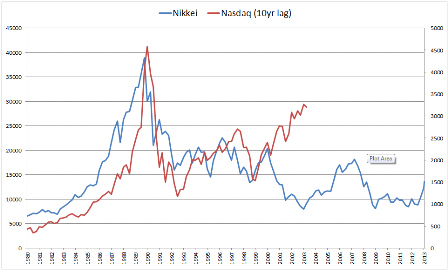

Some very interesting trends/divergences emerging:

1. Staples/Tech or cyclicals/defensives or low vol or correlations all falling completely off a cliff in spectacular fashion.

2. Forward P/Es in Japan vs in China and Korea massively diverging (fx-driven earnings drain, effectively, but only affects fwd PE this much if street is dramatically dramatically underestimating the fx impact on earnings)

3. You all know, Apple, GE, IBM vs S&P, etc.

Meanwhile consider the backdrop:

1. GE was a ‘shoot the messenger’ situation where their own ‘global growth market share’ looks fine but they say global leading indicators are poor so the market takes them down 5% and everyone else untouched

2. Weak USD, Strong commodities, China, and MOST IMPORTANTLY A MASSIVE US DEFICIT were fundamental drivers for US Equity performance for a long time. All are now pushing the opposite way. I am seeing ppl forecasting just 400+b for deficit within 2 yrs. Ppl still had 1T for this year a few months ago. It’s a STAGGERING, stealth development. It’s bad for stocks even if it’s from good growth. People thought the Fed was pumping stocks with ‘liquidity.’ There might have been some weak-USD effects but the FEDERAL BUDGET DEFICIT was the big driver. **Much of the deficit was winding up as corporate earnings the past few years rather than household income** Thus median incomes were flat, overall were up small, overall growth was small, and equity free cash flow and earnings growth has been chugging along at 7,8,9%. Where do you think that came from? Not from the Fed. That was blogoshpere nonsense. IT CAME FROM THE DEFICIT.

The biggest issue of course, is that free cash flow yields still make equities look dramatically cheap to bond-like alternatives… but they also are much more sensitive (over-sensitive) to turning points in things. If only as a punt on reactionary-ism stuff, I don’t like them here. Short for a trade. G’LUCK!

If the year end FICA hike and April 1 sequesters were enough to flatten housing demand, I suspect Q3 GDP forecasts will soon be seeing downward revisions.

And when I’ve asked some economic forecasters why they are posting 3% type numbers for Q3 they say ‘monetary stimulus’. Good luck with that one as well…

Conclusion: The financial repressionists have it all backwards

So the idea is the govt is ‘pushing rates down’ through QE and the like, thereby keeping rates below the rate of inflation, and that without this active ‘financial repression’ rates would otherwise be higher and not ‘repressed’.

That is, the govt is interfering with the ‘free market’ by said pushing of rates down, and this ‘distortion’ adversely affects all kinds of things, as happens with any interference in said ‘free markets’.

Well, to begin with, interest rates are subject to market forces with fixed exchange rate regimes, like a gold standard, currency board arrangement, or other such ‘peg’ where the govt by law exchanges the currency to some ‘reserve’ thing at a fixed rate. So today this would, at best, apply to HK, for example.

However, it does not apply to floating fx regimes, where the currency has no conversion features at the govt of issue, like the $US, yen, pound, euro, etc. etc. etc. contrary to the claims of the repressionists.

Either way, the currency is a public monopoly, with taxation a coercive, non market ‘interference’.

And, of course, monopolists are ‘price setters’ rather than ‘price takers’.

With a gold standard, for example, the govt sets the price of gold and in theory allows all other price to express relative value as they continuously gravitate towards floating indifference levels.

This includes interest rates (the ‘own rate’ for the currency) which then fluctuate based on ‘storage costs’ of the object of conversion which includes govt default risk with regard to conversion. The same holds for other fixed exchange rate arrangements.

With floating exchange rate policy, without govt interference, the ‘risk free rate’ is permanently at 0%, as there is no conversion option, and therefore no conversion default risk.

In this case, the only way rates can be supported at higher levels is by ‘govt interference’. This includes paying interest on reserve balances at the Fed, issuing Treasury Securities, and open market operations where the Fed buys and sells Treasury securities directly or via repurchase agreements and other such arrangements. All of these function as ‘interest rate support’ to keep rates higher than otherwise.

So once again, and another ‘who would have thought’, it seems the mainstream has it entirely backwards. Yes, govt is ‘interfering’ in the interest rate markets, but rather than engaging in ‘repression’ via ‘pushing rates down’ it’s instead engaging in ‘rentier support’ by pushing rates up.

So if these ‘free market types’ want to make the case that govt isn’t sufficiently interfering to push rates up to adequately support holders of various financial assets, fine. Bring it on! But more likely the realization of what they’ve actually be purporting should be embarrassing enough to cause them to back off for at least 3 or 4 minutes, don’t you think?

(Feel free to distribute)

Very good to see this here!

However, so far the politics haven’t changed, so place your bets accordingly!

Why the Reinhart-Rogoff paper was flawed right from the start

By Andrea Terzi