Now they give the nod to their life insurance companies and pension funds to back off?

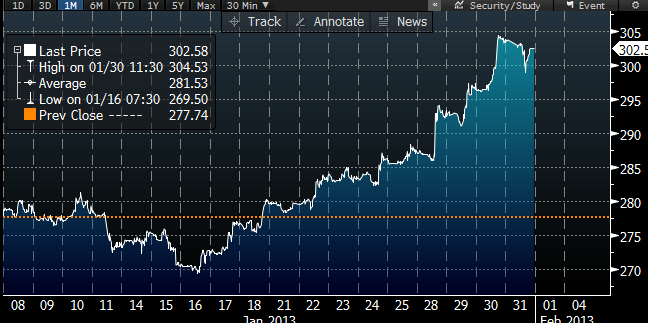

Aso: Yen Has Weakened More Than Intended

Feb 8 (Reuters) — Japanese Finance Minister Taro Aso said on Friday that the yen has weakened more than intended during its recent decline to around 90 per dollar from around 78 yen a few months ago.

The dollar fell about 1 percent versus the yen shortly after Aso comments, as traders pared bets on further declines in the Japanese currency.

Since November, the yen has fallen around 16 percent versus the dollar in anticipation that new Prime Minister Shinzo Abe will push his agenda of aggressive monetary policy easing to weaken the currency.

The finance minister’s comments indicate some surprise within the government at how quickly those expectations among traders translated into declines in the yen.

“It seems that the government’s policies have fueled expectations and the yen weakened more than we intended in the move to around 90 from 78,” Aso told lawmakers in the lower house budget committee.

Recently, Aso has reacted strongly to criticism from German and other European officials that Japan is intentionally trying to weaken its currency with monetary easing, so his comments on Friday could cause some confusion about Japan’s currency policy.

The dollar fell 1.3 percent on the day to 92.29 yen. The dollar hit an almost 3-year high of 94.075 yen earlier in the week on expectations the Bank of Japan will pursue aggressive monetary easing to shore up the economy.

Abe, while campaigning for an election last year, repeatedly said his economic policy had three arrows: monetary policy easing, fiscal spending and structural reforms to increase competitiveness.

Abe, since taking office in December, has put the central bank under relentless pressure to do more to lift the economy and made it clear he wants someone in the job who will be bolder than the outgoing BOJ chief in loosening monetary policy.

Current BOJ Governor Masaaki Shirakawa will leave his post on March 19.

Last month,the BOJ signed a joint statement with the government adopting a new 2 percent inflation target as a sign of its commitment to fighting deflation. It also announced a shift to “open-ended” asset buying.

Officials from the Group of 20 economic powers say that although top economic policymakers are likely to discuss how Japan’s new monetary stance is weakening the yen when they meet next month, they will stop short of calling it a competitive devaluation.