>

> (email exchange)

>

> Attached is an interesting article from the FT discussing the investment slowdown in China.

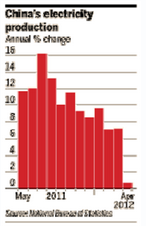

> While the official picture remains one of a gradual slowdown, more anecdotal data on

> electricity production and bank loans suggests that the slowdown is much more severe – this

> is likely to negatively impact the EM and the Asian suppliers to China such as Australia and

> Korea.

>

Full article: China Investment Boom Starts to Unravel