Boy in China reportedly sells kidney to purchase iPhone and iPad

April 6 — A teenage high-school student in China sold his kidney for an illicit transplant operation and used the proceeds to buy an Apple iPhone and iPad, state press said on Friday.

The 17-year-old boy, who was paid $3,500, was recruited from an online chat room and is now suffering from kidney failure and in deteriorating health, the Xinhua news agency said.

A surgeon and four others have been arrested and are facing charges of illegal organ trading and intentional injury.

The kidney donor, only identified by his surname Wang, agreed to the April 2011 operation in the central province of Hunan without his parents’ consent, the report said.

One of those detained was a hard-up gambler identified as He Wei, who acted as a middle-man between a hospital worker and the teenager.

Health ministry statistics show that about 1.5 million people in China need transplants, but only around 10,000 transplants are performed annually.

The huge gap has led to a thriving illegal market for organs.

Monthly Archives: April 2012

Employers Added 120,000 Jobs in March, Fewest in Five Months

Looking for a very bad opening and subsequent sell off in Asia and especially the euro zone as hopes of exports to the US fade leaving them no escape from their deteriorating domestic demand.

This is now the beginning of the endgame for the Euro zone, as they discover the firewall is another Maginot line that markets go through like a knife through butter.

Employers Added 120,000 Jobs in March

By Timothy R. Homan

April 6 (Bloomberg) — Hiring by American employers trailed forecasts in March, casting doubt on the vigor of the more than two-year-old economic expansion.

The 120,000 increase in payrolls reported by the Labor Department in Washington today was the smallest in five months and less than the most pessimistic estimate in a Bloomberg News survey of economists. The unemployment rate fell to 8.2 percent from 8.3 percent as people left the labor force.

Stock futures, the dollar and Treasury yields all fell as the report highlighted Federal Reserve Chairman Ben S. Bernanke’s concern that stronger economic growth is needed to keep the nation’s jobs engine humming. Today’s data also showed that Americans worked fewer hours and earned less on average per week, boding ill for the consumer spending that makes up 70 percent of the world’s largest economy.

“We see a lack of sustainability in terms of strong job growth,” Tony Crescenzi, a strategist at Pacific Investment Management Co. in Newport Beach, California, said in a radio interview on “Bloomberg Surveillance” with Tom Keene and Ken Prewitt. “This is still not strong enough to create escape velocity, which is to say an economy strong enough to make it on its own without additional monetary stimulus from the Federal Reserve.”

Among those having trouble finding work is Xander Piper, 30, who has been looking for a full-time job since September, when he completed a master’s program in social science at the University of Chicago. He decided to go to graduate school in 2010 to improve his employment prospects after losing his position at an advertising agency.

Expected Work Sooner

“When I graduated, I assumed I was going to get a job within the first couple of months,” said Piper, a San Francisco resident who said he’s looking for work in education and sometimes sends out 10 resumes a day.

“Now I work for a temp company, but even they’re having trouble staffing me,” he said. “I recently had a two to three month break at my temp company. What I have gotten recently is call center work, which is just brutal.”

A separate report today from the Fed showed consumer borrowing rose less than forecast in February, restrained by a drop in credit-card debt. Credit increased $8.7 billion, the least in four months, after an $18.6 billion gain in January.

Employment Forecasts

Employment in March was forecast to increase by 205,000, according to the median projection of 80 economists in the Bloomberg survey. Estimates ranged from increases of 175,000 to 250,000 after an initially estimated 227,000 gain the prior month.

S&P 500 futures expiring in June slumped 1.1 percent to 1,374.90 following the benchmark index’s 0.7 percent weekly loss. U.S. stock exchanges were shut for the Good Friday holiday. The dollar weakened 1 percent to 81.57 yen at 12:14 p.m. in New York, touching the lowest level since March 8. The yield on the benchmark 10-year Treasury note fell to 2.06 percent from 2.18 percent.

“We see modest growth inside the U.S. and demand for labor,” Carl Camden, president and chief executive officer of Kelly Services Inc. (KELYA) (KELYA), a Troy, Michigan-based staffing agency, said March 12 during a conference. The expansion is “a nice steady, not robust, not rock-and-roll, but a steady recovery, capable of producing a steady stream of jobs.”

Temporary Hiring

Employment at service providers increased 89,000 after a 211,000 gain in February. Professional and business service payrolls rose 31,000 last month, restrained by a 7,500 drop in temporary hiring.

J.C. Penney Co., the fourth-largest U.S. department-store company, is among employers cutting jobs. The company said today it notified about 1,000 workers, primarily in its headquarters in Plano, Texas, and its Pittsburgh customer call center, that their jobs will be cut as part of a restructuring plan.

Part of the slowdown in March may have reflected a warmer winter, which prompted some employers to hire more or retain workers in previous months than they otherwise would have, Paul Ashworth, chief U.S. economist at Capital Economics Ltd., said in an e-mail to clients. The average gain in payrolls from December through February was 246,000.

“We had mild weather, which basically had consumers in the marketplace earlier,” said Jack Kleinhenz, chief economist of the National Retail Federation, a Washington-based trade group. As a result, retailers postponed headcount reductions that typically follow the holiday shopping season, he said.

Retailers Cut Back

The March data showed a 34,000 decrease in retail employment, the biggest decline since October 2009. The Labor Department said today that the number of people unable to work due to inclement weather was 360,000 below average from December through February.

Temperatures in December through February averaged 36.8 degrees Fahrenheit (2.7 degrees Celsius), 3.9 degrees above the average in the 20th century, representing the fourth-warmest winter on record for the 48 contiguous U.S. states, according to the National Oceanic and Atmospheric Administration.

Some economists saw similarities with early 2011, when the economy slowed amid rising energy prices, a disruption of supplies caused by the tsunami in Japan and political gridlock in the U.S. over the debt ceiling.

This year, rising gasoline prices and the European debt crisis are taking a toll, said Mark Zandi, chief economist at Moody’s Analytics Inc. in West Chester, Pennsylvania.

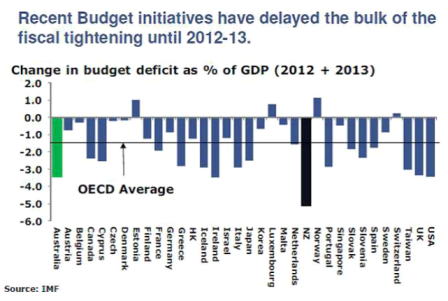

Impact of expected fiscal consolication measures on GDP

Below is a wonderful chart of fiscal initiatives and their expected impact on GDP. The chart highlights –

a) the two largest fiscal consolidations are expected to occur in NZ and Australia.

the planned consolidation in Australia is the biggest 1y fiscal consolidation on

record for Australia – this is expected to be formally introduced in their May

budget

b) number of initiatives are by the Eurozone countries (both core and peripheral) as they impose fiscal austerity to reduce debt burdens

c) significant negative impact on US GDP should tax cuts etc. that are currently in place are not extended at the end of the year.

Click here for larger version

Euro zone update

The joke used to be: ‘what’s the difference between bonds and bond traders?

Bonds eventually mature.

Except in the euro zone, post the Greek PSI ‘bond tax’, markets are starting to trade like maybe the don’t.

Yes, the ECB can come in and buy again, and probably will with more deterioration, but now it’s known that merely increases the risk of holding the remaining outstanding bonds, as the ECB’s bonds become ‘senior’and don’t get taxed.

So with deficits looking higher due to economic weakness due to mandatory austerity, the sustainability maths pointing to the bond tax route, and the ECB buying further adding to risk of loss, something has to give.

And it all remains potentially catastrophic for the global financial infrastructure, with aggregate demand remaining on the weak side globally and fiscal consolidation pending in most places.

Construction spending data leading to lower Q1 GDP estimates

>

> (email exchange)

>

> The following houses have lowered Q1 GDP:

>

> BAC, GS, Barclays, Noumura, DB, MS… most to just above 2% (2.1% for GS from 2.3%) or

> just below ( Nomura 1.9% from 2.1%). Barclays lowered their estimates by a full 0.4%

> to 2% flat.

>

Yen Drops Versus Peers as Tankan Fuels Easing Speculation

Right!

Lower rates!

More QE!

Be patient, monetary policy works with a lag

It’s only been 20 years

Hyper inflation is just around the corner…

Yen Drops Versus Peers as Tankan Fuels Easing Speculation

April 2 (Bloomberg) — The yen weakened versus all of its major peers after a Bank of Japan (8301) report showed that sentiment failed to improve at the nation’s largest companies, stoking prospects the central bank will boost monetary stimulus.

The Japanese currency slid against the dollar and euro as signs that manufacturing is improving in the U.S. and China, the world’s two biggest economies, undermined demand for haven assets. The euro remained higher after a quarterly gain versus the greenback as European governments called for a bigger global financial emergency fund after engineering a firewall to fight the region’s debt crisis.

“The worse-than-expected Tankan survey seems to be fueling talk that the BOJ will ease policy further,” Lee Wai Tuck, a currency strategist at Forecast Pte in Singapore, said about the central bank’s quarterly sentiment survey. “This is probably leading to selling of the yen.”

The yen lost 0.4 percent to 83.18 per dollar as as of 10:19 a.m. in Tokyo. It slid 0.4 percent to 110.97 per euro. Europe’s 17-nation currency was little changed at $1.3341 after rising 3 percent versus the greenback in the three months ended March 31.

The Tankan index for Japan’s largest manufacturers was unchanged last quarter from minus 4 in December, the BOJ said today in Tokyo. That was less than the median estimate of minus 1 in a Bloomberg News survey of economists. A negative number means pessimists outnumber optimists.

BOJ Meetings

BOJ policy board members are scheduled to meet April 9-10 and April 27 this month. The central bank held off from expanding asset purchases at its meeting in March as it monitored improvements in the economy. In February, it expanded bond purchases by 10 trillion yen ($120 billion) and set a 1 percent inflation goal in February.

The Institute for Supply Management’s factory index for the U.S. probably rose to 53 last month from 52.4 in February, according to the median estimate of economists surveyed by Bloomberg before the figures are released today.

An index of Chinese manufacturing climbed to 53.1 last month, the highest since March 2011, the logistics federation and the National Bureau of Statistics said yesterday. The measure has a pattern of rising each March.

bit more bad news for housing

Japan Must Overhaul Taxes to Avoid Bond Rout, Bank Lobby Says

Translation: Japanese bankers are against growth because it might cause losses from rate hikes?

Japan Must Overhaul Taxes to Avoid Bond Rout, Bank Lobby Says

By Shigeru Sato and Takako Taniguchi

April 1 (Bloomberg) — Japan must avoid delaying an overhaul of the tax system to prevent government borrowing costs from spiraling in the next decade, the new chief of the country’s banking lobby said.

“The risk of a tumble in government bond prices would increase if taxation and social security reform are left unsolved for years,” said Yasuhiro Sato, president of Mizuho Financial Group Inc. (8411), whose tenure as chairman of the Japanese Bankers Association began today. “The country’s financial assets are dwindling with the aging population dipping into savings.”

Japanese banks hold a record amount of the nation’s bonds, prompting central bank Governor Masaaki Shirakawa to warn in February that lenders risk incurring trillions of yen in losses if yields rise. Prime Minister Yoshihiko Noda faces opposition to his plan to double the sales tax by 2015 to pay for swelling welfare costs and contain the world’s biggest public debt.

“Any delays to the reform that’s being debated may raise concern that bonds may be unable to be absorbed domestically in the long run, say, in 2022,” Sato said in an interview last month. “But there are no signs of a JGB price plunge in the near term.”

Japan’s 10-year bonds yielded 0.985 percent late on March 30. The cost to insure Japan’s debt against nonpayment has been falling, with CMA data showing five-year credit default swaps declined to 98.6 basis points on March 29 from a record 154.8 on Oct. 4, indicating perceptions of creditworthiness are improving.

Hoarding Cash

Shirakawa said in February that a 1 percentage-point increase in benchmark yields would cause losses of about 3.5 trillion yen ($43 billion) on notes held by major banks. With households and companies hoarding cash rather than borrowing, lenders have been buying bonds, holding a record 167.8 trillion of sovereign debt in February, according to central bank data.

The International Monetary Fund dispatched a mission to Tokyo last month as part of a regular review it’s conducting this year into the stability of Japan’s financial sector. While the IMF’s Financial Sector Assessment Program contains a stress test for banks, brokerages and insurers, it’s unclear whether it will examine risks from their government bond holdings.

“Japan’s financial system is strong and stable,” Sato said. “It’s hard to imagine that the IMF would make any kinds of requirements for Japan” based on any examination of bonds held by financial institutions, he said.

Bond Profits

The nation’s three biggest lenders — Mitsubishi UFJ Financial Group Inc. (8306), Sumitomo Mitsui Financial Group Inc. (8316) and Sato’s Mizuho — earned a combined 231 billion yen from trading bonds and other securities in the quarter ended December, almost double from a year earlier, according to Bloomberg calculations based on their latest earnings figures.

Japan’s government bond sales have largely been absorbed by the domestic market, with about 92 percent of the debt owned by investors at home, central bank data show. The capacity of households to fund public spending may decline in coming years as the growing ranks of pensioners withdraw assets.

Households had 1,483 trillion yen of financial assets at the end of December, down 0.3 percent from a year earlier, according to the Bank of Japan. Government borrowings will climb to 1,086 trillion yen in the year ending March 2013, the Finance Ministry forecast in January.

Prime Minister Noda is seeking parliament’s approval of his tax bill in the current Diet session, while opposition Liberal Democratic Party leader Sadakazu Tanigaki has suggested elections should be called first. Noda’s Cabinet on March 30 approved the proposal to raise the sales levy to 8 percent in April 2014 and 10 percent in October 2015.

“Japanese banks conduct their own simulations and assessments of various risks such as those arising from bonds and stocks,” Sato said. “We are now far from the situation where a bomb may explode in the near future.”