Did Taxpayers Really ‘Profit’ From Treasury Mortgage Program?

By John Carney

Monthly Archives: March 2012

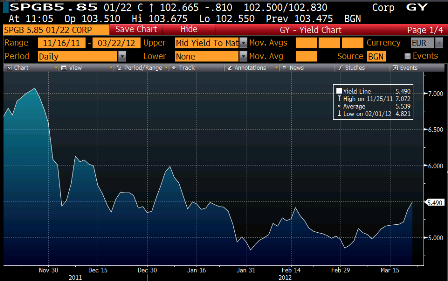

Spanish rates

LTRO’s and bank liquidity not withstanding, Spanish rates reversed and began moving higher immediately after they thumbed their noses at the markets and announced they had decided not to take additional austerity measures to meet their immediate deficit targets.

Not being the issuer of the euro, like all the euro member nations, they are fully exposed to a Greek like liquidity crisis, as they can not spend without prior funding, much like the US states.

Click here for larger version

EUR PMIs-Big GDP Implications

And not only no change in fiscal policy, but more of same. As the carpenter said about his piece of wood, ‘no matter how much I cut off it’s still too short.’

Fertile ground for the ‘bond tax’ (PSI) for the next round of austerity, to reduce the need to further cut public services and raise domestic taxes.

Karim writes:

As mentioned before, PMI surveys in Europe are the most timely and important economic data point for the ECB; they have the greatest weight in the ECB’s model of estimating current quarter and quarter ahead growth.

Today’s data was weaker across the board, with Germany surprisingly weak in particular.

- Euro composite PMI fell for the second month in a row, from 49.3 to 48.7

- Weakness was led by manufacturing, down from 49 to 47.7

- German manufacturing was especially weak, falling from 50.2 to 48.1

- French PMI slipped back below 50, from 50.2 to 49

The impact on GDP according to NowCasting (which uses a similar framework as the ECB) was a downward revision to Q2 real GDP growth from +0.6% (annualized) to -0.6% (annualized) for the EuroZone, and from 0.1% (annualized) to -1.2% (annualized) for Germany.

This data should certainly push up the probability of an ECB policy rate cut in May or June.

Hints of Portugal PSI?

From Morgan Stanley

Note the talk of a PSI (bond tax):

5. Portugal: Portugal’s five-year bonds are trading at ~16%, right around the level where Greek bonds traded last April when Eurozone officials began to turn their attention to forcing losses on private sector creditors. The key area of concern in the market is a €9.7B bond maturing in September 2013 that is not covered by the country’s €78B bailout. Portugal needs ~€25B-€30B to fund itself through 2015. Portuguese officials hope that a pickup in market confidence will allow it to return to the bond market in time to refinance the 2013 bond. The Portuguese funding concerns have been widely discussed in the press. While there has been speculation that the country could be next in line for a debt restructuring, this outcome has been disputed by both Portuguese and troika officials.

MMT inspired euro fix

Spend in euro denominated tax credits.

Central banks pay ecb rates on said deposits charged to issuer.

Eurachma

Esceuro

Passeuro

Punteuro

Leuro

All perfectly legal under current institutional arrangements

Central bank gold buying

Cutting spending, hiking taxes, and no qualms about buying gold…

Gold up on central bank buying talk but outlook weak

By Frank Tang and Amanda Cooper

Three weeks of upbeat U.S. data have made investors more confident about the economy and less eager to hold gold as insurance against another slowdown. The resulting steep rise in benchmark 10-year U.S. Treasury yields has weighed on gold.

Central banks have also reportedly been active buyers of gold in recent weeks, having bought as much as 4 metric tons of metal, according to an industry source and theFinancial Times on Friday.

They were net buyers of gold last year for a second straight year with a 439.7 tonnes purchase in 2011. In the two decades prior to 2010, central banks as a group had consistently been net sellers of gold. Analysts said that talk of official-sector gold buying should bolster investor confidence as central banks tend to be very long-term owners of the precious metal.

Warren on Barry Armstrong radio

Inflation expectations

Seems all those hyper inflation forecasts haven’t had all that much influence.

;)

Cleveland Fed Estimates of Inflation Expectations

The Federal Reserve Bank of Cleveland reports that its latest estimate of 10-year expected inflation is 1.38 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

BINI SMAGHI SAYS EU MUST ACT TO SHOW GREEK PSI AN EXCEPTION

‘Must’ is a good choice of words because if they fail the consequences are financially catastrophic.

*BINI SMAGHI: EU MUST RECOGNIZE PORTUGAL MAY NEED MORE AID

*BINI SMAGHI SAYS EU MUST ACT TO SHOW GREEK PSI AN EXCEPTION

*FORMER ECB OFFICIAL BINI SMAGHI COMMENTS IN FT OPINION ARTICLE

*BINI SMAGHI SAYS PORTUGAL MAY NEED EU100 BILLION *BINI SMAGHI SAYS IRELAND MAY NEED ADDITIONAL EU80 BILLION

more on Ireland testing the waters

>

> (email exchange)

>

> One prominent Irish minister said explicitly that we should use Greece as a bargaining chip > to renegotiate the promissory note. The whole government and press went crazy saying that > she was completely out of line etc.

>

that’s how it starts?

;)