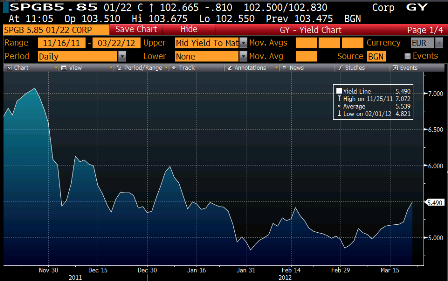

LTRO’s and bank liquidity not withstanding, Spanish rates reversed and began moving higher immediately after they thumbed their noses at the markets and announced they had decided not to take additional austerity measures to meet their immediate deficit targets.

Not being the issuer of the euro, like all the euro member nations, they are fully exposed to a Greek like liquidity crisis, as they can not spend without prior funding, much like the US states.

Click here for larger version