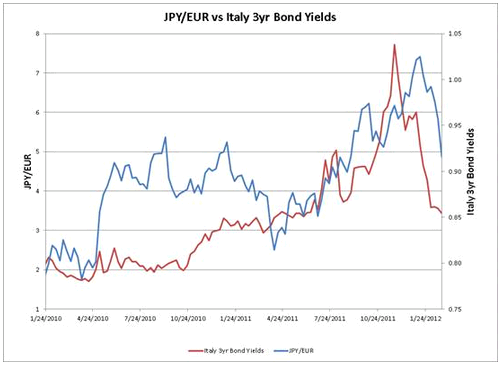

Just a hunch now, but Italian, Spanish, and related bond yields began falling coincident with the first ECB LTRO. The question is why, as I saw no operative channel of consequence from ECB liquidity provision of 3 year funds on a floating rate basis to the term structure of rates.

So it seemed to me that also coincident to the LTRO was some entity giving the nod to its banks to buy those bonds, or some reason sellers of those bonds backed off.

I’m now thinking it may have been the BOJ giving the nod to its member banks to buy euro member debt denominated in euro and keep the fx risk on their books, with the assurance govt policy would keep the yen weak and guarantee the banks an fx profit.

We learned after the fact that Japan had been selling yen well before they announced their new weak yen stance. And having their banks buy euro member euro denominated debt directly weakens the yen vs the euro.

The timing of the events- the LTRO/yen sell off/yen policy change- is close enough to get my attention.

So Japan managed to weaken the yen and firm euro member debt prices all under the cover of the ECB LTRO operation which they gladly allowed to take the credit.

In any case, I don’t expect any more from this next LTRO than I expected from the last, but I am keeping a close eye on the yen.