And this Fed fears deflation a lot more than inflation:

- We see signs that the upside inflation surprises of 2011 have ended. Our new statistical summary of the price components of business surveys such as the ISM, Philly Fed, and NFIB points to decelerating inflation. In addition, our unweighted CPI diffusion index, which measures the breadth of price changes across 178 detailed price categories, fell to its lowest level since late 2010.

Inflation has been above our expectations in 2011, but we expect a substantial part of this surprise to reverse and see core inflation clearly below the Fed’s “mandate-consistent” level of 2% or a bit less by the end of 2012. The reasons are straightforward. There is still a large amount of slack in the US economy; nominal wage inflation remains very low; and much of the inflation pickup of 2011 can be traced to temporary factors such as short-term commodity price pass-through and upward pressure on motor vehicle prices in the wake of the Japanese earthquake. (We do not expect a full reversal of the core inflation pickup because the increase in rent inflation is likely to be more persistent.)

The recent inflation data have started to look more consistent with our view of moderating core inflation. The consumer price index (CPI) excluding food and energy has risen at an annualized rate of just 1.2% over the past two months, the lowest rate since December 2010 Statistically based measures of core inflation such as the Cleveland Fed’s weighted-median and 16% trimmed-mean CPI send a similar message.

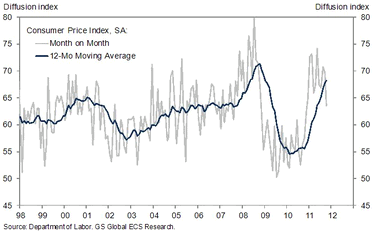

Our unweighted CPI diffusion index is also starting to look a bit more benign again. It is constructed by seasonally adjusting all 178 individual CPI categories for which we have sufficient data, calculating the month-to-month change, and then reporting the percentage of categories showing price increases plus half the percentage showing no change. That is, values above 50 indicate that more categories are seeing price increases than decreases; the higher above 50, the greater the breadth of price increases relative to price decreases. (We perform our own seasonal adjustment because the Labor Department only provides seasonally adjusted CPI data for a subset of product categories.) Exhibit 1 below shows our diffusion index. While it is still clearly above the levels of 2009 and 2010, the October 2011 reading was the lowest since November 2010.

Exhibit 1: CPI Diffusion Index Has Started to Slow

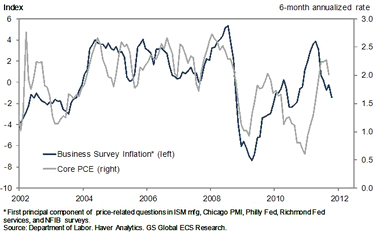

To gain more insight into future inflation trends, we have constructed a new measure that summarizes the inflation signal from various business surveys. Specifically, we calculated the first principal components of the price-related questions in the monthly ISM, Chicago PMI, Philly Fed, NFIB, Kansas City Fed, and Richmond Fed business surveys. These questions refer to prices paid, prices received, or wages and salaries and are generally reported as the difference between the percentage of respondents saying that prices rose in the survey month and the percentage saying that prices fell. (Focusing only on prices paid or prices received indexes does not make a significant difference to the results.)

The results are shown in Exhibit 2 below. In general, our business survey indicator of inflation tracks the ups and downs of the core PCE index–the Fed’s favorite measure of underlying inflation–reasonably well. After a significant acceleration in early 2011, the indicator has declined notably in recent months and is now consistent with a deceleration in core PCE inflation from the recent 2%+ level to somewhere closer to 1.5%. This is also consistent with our forecast that inflation will slow over the next year.

Exhibit 2: Business Survey Inflation Shows Recent Deceleration