I thought he did a AAA job within his paradigm.

The answers on the dollar were spot on- ultimately the dollar is worth what it can buy, so ‘low inflation’ is a strong dollar policy in the long term. It’s pretty much the purchasing power parity argument. Additionally, he said a strong economy helps the dollar, citing the capital inflow channel, probably a reference to China and other emerging market nations. And I might have added the fiscal tightening channel, as strong economies tend to cause federal deficits to fall via automatic fiscal stabilizers.

Interestingly, he did not mention specifically how higher oil prices, set by a foreign monopolist, continue to work against the dollar.

Nor how highly deflationary policies in other currencies tend to strengthen those currencies relative to the dollar.

And there was no mention of how portfolio shifting alters the dollar, which may be the largest driver currently.

Let me suggest, however, it would have been more nearly correct for him to have said the policy of low inflation and strong growth also happens to support the dollar, rather than imply a strong dollar was the policy variable.

He remains out of paradigm on the QE issue, still not realizing it’s entirely about price and not quantity, but that was to be expected.

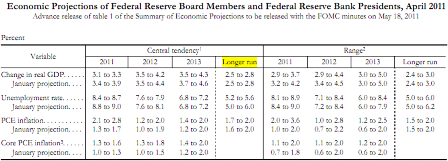

The more dovish tone from the FOMC indicates some fundamental insecurity about the economy. Yes, they remain moderately optimistic, but probably continue to worry disproportionately about the downside risks. They see downside risks to demand everywhere from the euro zone and the UK, to Japan and China, and, though recognizing nothing of consequence has happened yet, they hear the fiscal sabre rattling from both the left and the right. And they see it’s unlikely for the housing channel to provide much support in the near future as it’s done in previous cycle.

Also, second chance to buy my 100oz gold bar at the current spot price of gold!

When I offered it for sale when gold was $1,200, no one wanted it so I still have it.

:)

Karim writes:

1) Extended period means a ‘couple of meetings’.

2) Q1 GDP weakness transitory (i.e., they didn’t alter the outlook for rest of f/cast period) due to

a. timing of defense outlays

b. timing of export shipments

c. weather

3) No fiscal measures that have been announced so far have altered their near-term outlook

4) Impact of Japan supply disruptions ‘moderate and temporary’

5) Strong and stable dollar in U.S. best interest