Daily Archives: April 14, 2011 @ 11:33 am (Thursday)

CH Daily | New yuan lending falls to 2.24 trillion

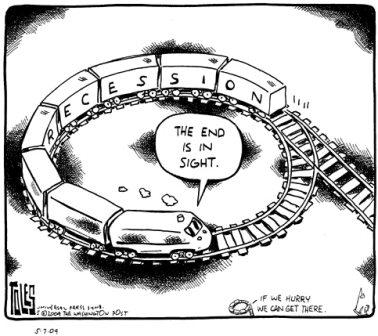

More evidence of restricted state lending as the fight against inflation continues.

To their credit, no signs of an actual hard landing yet, but the battle is still on.

China’ new loans stand at 2.24t yuan in Q1

(Xinhua) The People’s Bank of China (PBOC), the country’s central bank, said that new yuan-denominated loans stood at 2.24 trillion yuan ($342.83 billion) in the first quarter of 2011. The figure was 352.4 billion yuan less than that in the same period of last year, said the PBOC in a statement on its website.

Banks suspend mortgage loans

(China Daily) Some bank outlets in Shanghai have suspended mortgage loans to home buyers, the China Securities Journal reported. An anonymous developer said, the Shanghai outlets of the China Industrial and Commercial Bank, the Agricultural Bank of China, the China Minsheng Banking Corp Ltd and the Industrial Bank Co Ltd all suspended issuing loans. “Banks do want to lend, but they may have no money for lending” the developer said. China has raised the reserve ratios for banks nine times since last year, and 3 trillion yuan of banks’ capital has been frozen as a result. Sources with the above mentioned banks said they have not stopped mortgage loans, but have more strict requirements for granting these loans.

Beijing March New House Prices Plunge 26.7% M/M: Press

BEIJING (MNI) – Prices of new homes in China’s capital plunged 26.7% month-on-month in March, the Beijing News reported Tuesday, citing data from the city’s Housing and Urban-Rural Development Commission.

Average prices of newly-built houses in March fell 10.9% over the same month last year to CNY19,679 per square meter, marking the first year-on-year decline since September 2009.

Home purchases fell 50.9% y/y and 41.5% m/m, the newspaper said, citing an unidentified official from the Housing Commission as saying the falls point to the government’s crackdown on speculation in the real estate market.

Beijing property prices rose 0.4% m/m in February, 0.8% in January and 0.2% in December, according to National Bureau of Statistics data.

The central government has launched several rounds of measures since last year designed to cool the housing market, though local government reliance on land sales to plug fiscal holes mean enforcement hasn’t been uniform.