MMT breaking through???

Deficit hysteria grips Washington

By Darrell Delamaide

February 16 (MarketWatch) — Deficit hysteria is rising to fever pitch in Washington as the political jockeying over the budget begins in earnest.

“Fiscal nightmare,” “buried under a mountain of debt,” “awash in red ink” – these are some of the colorful phrases being bandied about by politicians, pundits and even journalists ostensibly reporting facts. Most of them are winging it on a single undergraduate course in economics, if that, but they know they’re right because everybody agrees.

Yet, if you look out the window, you don’t see any red ink or mountains of debt. The only nightmare is unemployment continuing near 10% and ongoing waves of foreclosures – neither of which is attributable to the federal deficit and neither of which will be fixed by budget cuts.

There is no visible harm from current deficits. Yields on U.S. Treasurys are up a tick but still near historic lows. Core inflation in the U.S. is still so far below the 2% annual rate deemed desirable by the Federal Reserve that deflation continues to be more worrying. There is no crowding out of private borrowers in the debt markets.

Just you wait, cry the deficit hawks, it will be a nightmare by 2016 or 2020 or 2050. Well, let’s wait and see. If we put those 15 million people back to work and get the economy growing at a steady clip, tax revenues will rise and cheat all those bloodthirsty hawks of their fiscal Armageddon.

Worried? Confused? Alarmed at the slow-motion train wreck in Washington?

There is cause for alarm. There is the possibility that the government, held under the sway of misguided and obsolete economic theories and driven by a not-so-hidden corporate agenda, will make genuinely harmful cuts in both discretionary spending and entitlement programs – cuts that will cause real and needless misery to millions.

The overwrought hysteria of the deficit hawks – one economist calls them deficit terrorists – has already sabotaged government stimulus that could have rebooted the economy much more quickly and alleviated unemployment to a greater extent.

It’s certainly useful to comb through the budget and reexamine programs for possible cuts. Military spending can certainly be cut back. Some recalibration of entitlements is also necessary.

But the helter-skelter axing of programs to meet a target pulled out of thin air – what’s so magic about $100 billion in spending cuts this year? – risks causing much unnecessary harm.

Before you succumb to the deficit hysteria, think about the disconnect between the dire language and the observable facts. Be careful about false comparisons – such as the U.S. going the way of Greece.

The U.S. is not Greece. The U.S. has full monetary sovereignty – that is, it has complete control over its own currency. Greece, as a member of the euro, does not, which is why it has constraints on its borrowing.

When the U.S. was bound by the gold standard, it also faced constraints. Most of the thinking and language about budgets and deficits actually goes back to this time, when the U.S. genuinely had to “finance” its deficit.

Since abandonment of the gold standard and the de facto adoption of a fiat currency, however, these constraints no longer apply. The U.S. is free to print as much money as it likes; the U.S. government is free to spend money without financing it.

How crazy, you say. What about inflation? Inflation occurs when there is more demand than supply and this simply isn’t going to happen when there is 8-10% unemployment. Treasury and the Fed have ample tools – selling debt securities and raising interest rates – to deal with inflation when it does threaten.

Modern monetary theory – which is espoused by a growing number of economists and investment managers because it explains the observable facts better than the obsolete theories driving most of the public discussion – deals with the world as it is without a gold standard.

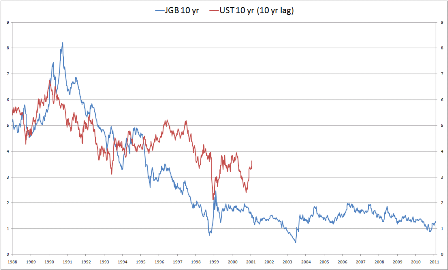

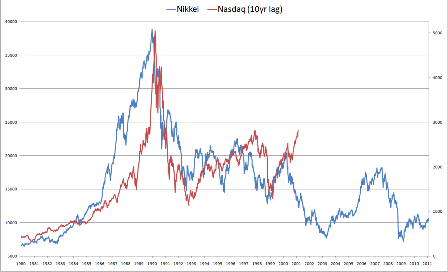

A better comparison for the U.S. than Greece is Japan, which also enjoys full monetary sovereignty. Japan has a public debt approaching 200% of GDP. This compares to the U.S. at 60% in 2010 and on its way up.

Deficit terrorists have decided arbitrarily that 60% is the maximum limit. They have been predicting the imminent collapse of Japan – for the past 20 years. And yet Japan continues to finance its deficit with rock-bottom interest rates.

The federal government is also not comparable to a household. It does not have a checkbook to balance or a credit card to max out, even though our folksy politicians like to use these metaphors. It does not have to “live within its means” like a family or individual. Our grandchildren will never have to repay all that debt. No one will, ever. It will continue to grow as our economy grows.

All this flies in the face of all the groupthink going on in Congress, in the press and on cable TV. So if you want to reject modern monetary theory as hogwash and cling to theories that worked a century ago, you’re in good company. But think about it, look around you, and decide for yourself what best describes the world you live in.