>

> (email exchange)

>

> On Tue, Feb 22, 2011 at 9:15 PM, wrote:

>

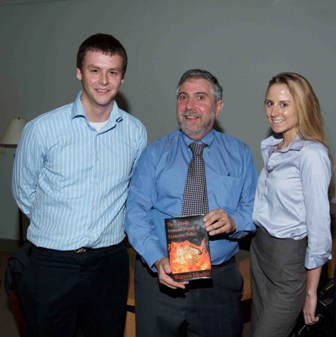

> Paul Krugman gave a speech at Florida Atlantic University and agreed

> to a brief meeting with our econonomics club.

>

> I thought you might enjoy the attached picture.

>

Mosler Economics / Modern Monetary Theory

The Site of Economist Warren Mosler