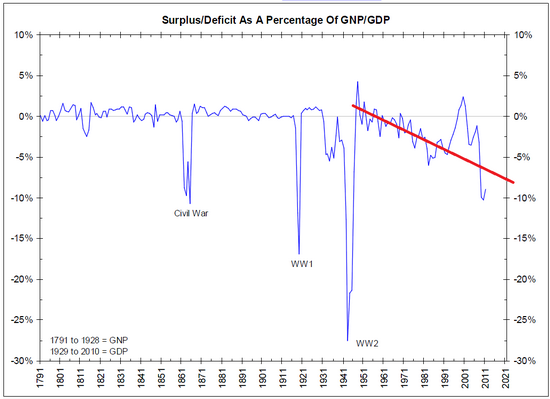

Wondering if something like the red line I drew might be some kind of approximation of what the ‘neutral’/full employment deficit needs to be.

The reason would be the ‘demand leakages’ that seem to grow geometrically due to tax advantages, such as funds being added to and compounding in pension funds, insurance reserves, CB reserves, etc etc etc?

If so, with the mainstream valuing lower deficits, and real limits to private sector credit expansion, seems the output gap is a whole less likely to narrow to full employment type of levels.

And the Fed could be low forever, much like Japan.