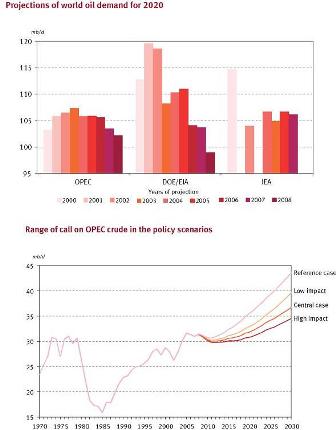

Note the ‘demand destruction’ refers to the slowing of the growth of demand, not a contraction.

Oil Demand Forecast

[top]

Note the ‘demand destruction’ refers to the slowing of the growth of demand, not a contraction.

[top]

Seems to me GM and the banks need the same thing: people who have sufficient income to buy cars and make mortgage payments.

In general, direct public spending is for public goods: military, legal system, various infrastructure, etc.

To support private sector output the way to go is to support demand, and let consumers decide which products succeed and which don’t.

If government had declared a payroll tax holiday (treasury makes the fica payments for employees and for the business) three months ago, car sales would be up and mortgage delinquencies down.

And don’t forget to toss in something that reduces fuel consumption sustain our real terms of trade.

[top]

Looks like payback for political help, not ‘change’:

Members of the Transition Economic Advisory Board:

[top]

Bad news, the Feds outstanding (unlimited) swap line draws were up $27.9 billion to $573.9 from last week’s report.

That’s a larger increase than the approximately 24 billion increase the week before.

This is not good.

Each increase gets us closer to the day when the Fed says ‘no mas’.

Causing the euro’s decline to accelerate as the eurozone faces collapse.

http://www.federalreserve.gov/releases/h41/Current/

[top]

| Survey | -200K |

| Actual | -240K |

| Prior | -159K |

| Revised | -284K |

| Survey | n/a |

| Actual | -1078.00 |

| Prior | -698.00 |

| Revised | n/a |

| Survey | 6.3% |

| Actual | 6.5% |

| Prior | 6.1% |

| Revised | n/a |

| Survey | -65K |

| Actual | -90K |

| Prior | -51K |

| Revised | -56K |

| Survey | n/a |

| Actual | -3.8% |

| Prior | -3.2% |

| Revised | n/a |

Karim writes:

Payrolls:

Worse than expected (but that was expected)

By industry:

| Survey | 0.2% |

| Actual | 0.2% |

| Prior | 0.2% |

| Revised | n/a |

| Survey | 3.5% |

| Actual | 3.5% |

| Prior | 3.4% |

| Revised | n/a |

| Survey | 33.6 |

| Actual | 33.6 |

| Prior | 33.6 |

| Revised | n/a |

| Survey | 0.3% |

| Actual | -0.1% |

| Prior | 0.8% |

| Revised | 0.6% |

Falling?

| Survey | n/a |

| Actual | 9.7% |

| Prior | 10.9% |

| Revised | n/a |

Past the peak?

| Survey | n/a |

| Actual | 89.2 |

| Prior | 93.5 |

| Revised | n/a |

Still a mini trend higher.

| Survey | -3.4% |

| Actual | -4.6% |

| Prior | 7.4% |

| Revised | 7.5% |

| Survey | n/a |

| Actual | 7.7% |

| Prior | 5.1% |

| Revised | n/a |

Not bad! probably lots of foreclosure sales.

[top]