by Ben Russell, Political Correspondent and Sean O’Grady

Britain is facing the risk of renewed turmoil in the financial markets, the new deputy governor of the Bank of England warned yesterday.

Professor Charlie Bean, the deputy governor for monetary policy and a former chief economist at the Bank, raised the prospect of a slowing global economy triggering a new round of problems with corporate loans and said that the impact of the credit squeeze could be greater than Bank projections.

Yes, but unlike the Eurozone, the BoE is permitted to ‘write the check’ as in the treasury.

National solvency is not an issue in the UK as it is in the Eurozone when weakness is addressed.

He told members of the Commons Treasury Select Committee that Britain faced “major conflicting risks” threatening the Government’s inflation target from the problems of a slowing economy and rising commodity prices.

Yes, the twin themes of weakness and inflation.

In a memorandum to the committee, Professor Bean warned that the “dislocation” in the financial markets “probably has further to run, especially if a slowing economy here and abroad generates a second round of write-downs, this time associated with corporate loans. Moreover, the impact of the tightening in the terms of availability of credit could prove greater than is embodied in the central case in our most recent set of projections”.

Agreed. And while ‘writing the check’ can readily address these issues with no risk to government solvency, it will also support the higher prices he next discusses:

He said that increasing oil and other commodity price rises would lead to higher inflation becoming “embedded in the economy”, warning that people might seek to offset price increases by making higher wage demands. He said: “There is no doubt that the UK economy presently faces the most challenging set of circumstances since at least the early 1990s and probably earlier.”

Professor Bean said oil prices could continue to rise for another two years and cautioned that Britain faced the danger of a pay-price spiral if workers tried to compensate by pushing up wages. He said: “It certainly poses a significant challenge. There is no doubt about that at all. It may be a relatively unlikely event but it could be particularly unfortunate if it happened, if households and businesses start losing faith in the idea that inflation will stay low, round about the target, they start building it into their pay and prices and inflation becomes much more embedded into the system… Provided pay growth remains subdued, the current pick-up in inflation will be temporary.”

Living standards, the deputy governor stressed, will inevitably be lower because of the global inflation in commodity prices.

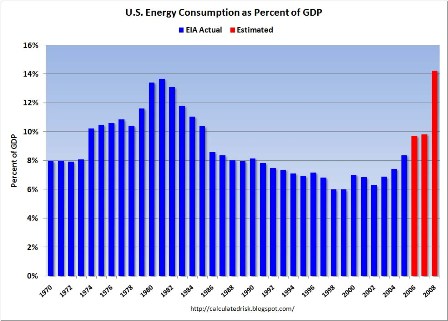

Agreed. It’s all about real terms of trade, which have also been declining rapidly in the US as evidenced by the drop in growth of GDP and the drop in non-oil trade deficit.

My guess is the most likely political response in the US and the UK is proactive deficit spending from the treasury to address the weakness and higher interest rates to address the inflation.

Unfortunately the deficit spending that supports domestic demand will also support crude consumption (as well as housing) and ‘monetize’ the ever higher crude prices being set by the Saudis, thereby supporting ‘inflation’ in general.

And this will trigger ever higher interest rates from the Central Bank as inflation trends even higher.