- MBAVPRCH Index (Released 7:00 EST)

- MBAVREFI Index (Released 7:00 EST)

- Nonfarm Productivity Released 8:30 EST)

- Unit Labor Costs (Released 8:30 EST)

- Pending Home Sales MoM (Released 10:00 EST)

- Consumer Credit (Released 15:00 EST)

MBAVPRCH Index (May 2)

| Survey | n/a |

| Actual | 381.3 |

| Prior | 340.1 |

| Revised | n/a |

Seems to have at least stabilized.

MBAVREFI Index (May 2)

| Survey | n/a |

| Actual | 2773.8 |

| Prior | 1905.2 |

| Revised | n/a |

Doing okay.

Nonfarm Productivity (1Q P)

| Survey | 1.5% |

| Actual | 2.2% |

| Prior | 1.9% |

| Revised | 1.8% |

Better than expected. Usually rises with output.

Unit Labor Costs (1Q P)

| Survey | 2.6% |

| Actual | 2.2% |

| Prior | 2.6% |

| Revised | 2.8% |

Better then expected, prior revised up. This series isn’t doing much.

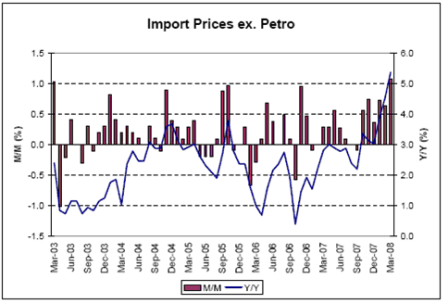

Look to imports from China for a handle on unit labor costs as well.

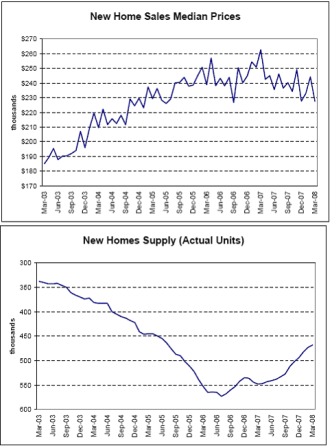

Pending Home Sales MoM (Mar)

| Survey | -1.0% |

| Actual | -1.0% |

| Prior | -1.9% |

| Revised | -2.8% |

Still falling some, seasonally adjusted, and with actual inventory going down there is less to buy.

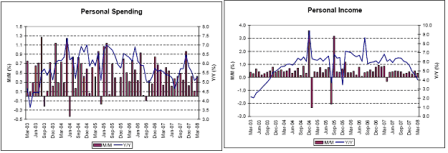

Consumer Credit (Mar)

| Survey | $6.0B |

| Actual | $15.3B |

| Prior | $5.2B |

| Revised | $6.5B |

Volatile series.

Seems to be holding up as incomes hold up.

[top]