Looking more like a bottom with every report. And most housing reports are ‘fighting’ some strong seasonals in the spring.

by Shobhana Chandra

(Bloomberg) New-home sales in the U.S. unexpectedly rose in April after readings for the prior month were revised down, signaling a worsening housing slump is still a threat to the economy.

Sales increased 3.3 percent to an annual pace of 526,000 from a 509,000 rate the prior month that was the lowest in 17 years, the Commerce Department said today in Washington. A separate report today showed home prices dropped in the first quarter by the most in at least 20 years.

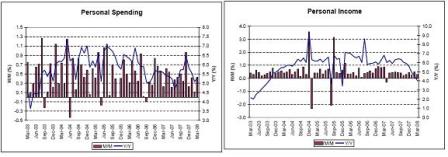

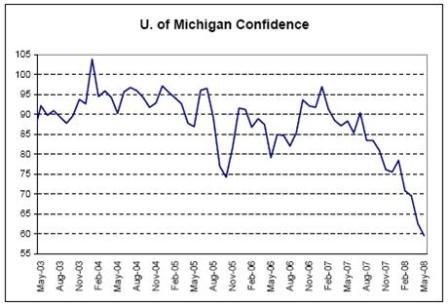

A separate report today showed confidence among American consumers fell to the lowest level since October 1992 this month, raising the risk that households will rein in spending. The Conference Board’s confidence index declined more than forecast to 57.2.

They already have reined it in. That´s what an export economy looks like!

Economists’ Forecasts

Economists forecast new home sales would drop to a 520,000 annual pace from an originally reported 526,000 rate the prior month, according to the median estimate in a Bloomberg survey of 70 economists. Forecasts ranged from 500,000 to 570,000.

Purchases in April were the second lowest since October 1991. The March reading became the weakest since April 1991.

The median sales price last month increased 1.5 percent from April 2007 to $246,100. The figures can be influenced by changes in the mix of sales at the regional level. For that reason, economists prefer price measures that track the same house over time.

They never added that type of comment when prices fell. Still a lot of biased reporting out there.

One such gauge is the S&P/Case-Shiller index. Those figures, also reported today, showed house prices dropped 14.1 in the first quarter compared with the same period in 2007, the biggest decline since records began in 1988.

Much narrower market and different months

Sales of new homes were down 42 percent from April 2007, the biggest year-over-year decline since September 1981, the Commerce report showed.

Better to be 10 miles from hel_ and moving away from it than 100 miles away moving towards it.

Drop in Inventories

One bright spot is that inventories decreased. The supply of homes at the current sales rate dropped to 10.6 months’ worth from 11.1 months in March. The number of homes completed and waiting to be sold decreased to 181,000, the fewest since July.

Shortages looming as suggested in prior emails.

Purchases rose in three of four regions, led by a 42 percent jump in the Northeast. They increased 8.3 percent in the West and 5.8 percent in the Midwest. Purchases dropped 2.4 percent in the South.

Sales of previously owned homes, which account for about 85 percent of the market, fell 1 percent in April, and the supply of unsold properties reached a record, the National Association of Realtors said last week.

New-home purchases, which make up the remaining 15 percent of the market, are considered a timelier indicator because they are based on contract signings. Resales are calculated when a contract closes, usually a month or two later.