My take on the USD:

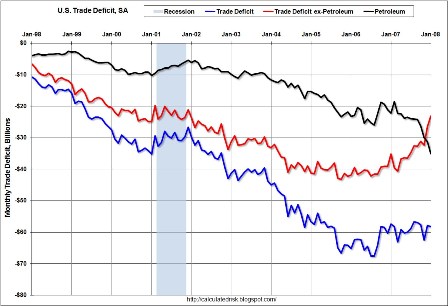

It was at a level based on foreigners wanting to accumulate $70 billion per month which also = the US trade gap (accounting identity).

Most of that desire to accumulate came from foreign CBs trying to support their exporters, oil producers accumulating USD financial assets, and foreign portfolios allocating some percentage of assets to USD assets.

Paulson cut off the CBs calling the currency manipulators and outlaws.

Bush cut off the oil producers by being perceived to be conducting a holy war.

Bernanke scared off the portfolio managers with what looks to them like an ‘inflate your way out of debt’ policy.

And US pension funds are diversifying out of USD into passive commodities and foreign securities. Looks to me like the desire to accumulate USD overseas is falling towards zero rapidly.

This means they sell us less and buy more of our goods, services, and our real assets.

Volumes’ of non oil imports are falling and of oil imports are flat.

The dollar has gotten low enough for the trade gap to fall from over $70 billion to under $60 billion per month (February was an aberration IMHO).

The dollar will ‘adjust’ until it corresponds with a trade gap that = desired foreign accumulation of USD financial assets.

I see no reason to think the trade gap should not go to zero.

The USD probably has not traded down enough to reflect the zero desire to accumulate USD abroad.

The ECB has serious ideological issues regarding buying of USD. Not the least of which they don’t want to give the impression that the USD is ‘backing’ the euro, which would be the appearance if they collected USD reserves.

The ECB has an inflation problem, and they believe the strong euro has kept it from being much worse.

The policy ‘shift’ might be the process of ending of US rate cuts at the next meeting by cutting less than expected.

This might first mean only a 25 basis point cut when the market prices in 50 basis points, followed by no cut when markets price in 25 basis points, for example.

This would firm the USD and soften the commodities near term, as after the last 75 basis point cut when markets were pricing 100 basis points.

But this does not change the foreign desires to accumulate USD as direct intervention by the ECB would, for example.

So the adjustment process that gets us to a zero trade gap will continue.

And it will continue to drive up headline CPI with core not far behind.

And US GDP will muddle through in the 0% to +2% range with weak private sector consumption being supported by exports, US government consumption, and moderate investment.